In the past, financial advisors made their living by commissions. Often they wouldn’t see the same client again unless there was another relevant product to sell. Fast forward to today, and many advisors are looking for ways to build more meaningful relationships with clients and avoid conflicts of interest. Clients themselves are demanding more time and more financial planning services from their advisors1, and most are willing to pay for it.2

Given growing industry regulations and increasing client expectations, it's no wonder that commissions are falling out of favor, and being replaced by new models like fee-only and subscription-based pricing. As clients increasingly recognize the value of personalized, ongoing financial advice, fee-based and subscription-based billing has a tendency to suit both advisors and their clients better.

The shift to fee-based pricing

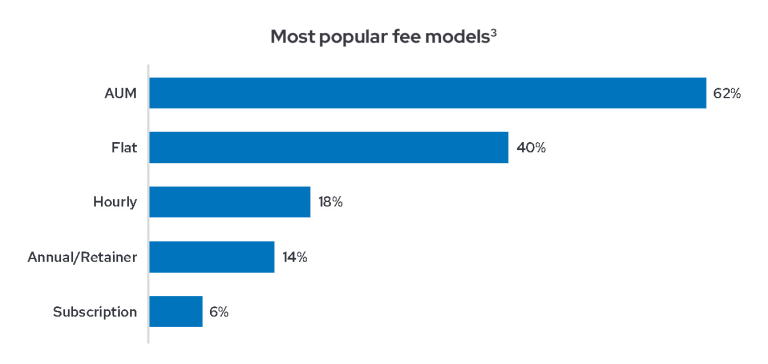

Today, more and more advisors are using fee-based pricing. In a survey of 600 advisors by Envestnet MoneyGuide, AUM was the most popular fee model, with 62% of advisors reporting receiving a fee based on a percentage of clients’ assets.3 Other commonly-used fee structures are flat, hourly, or annual retainer fees. Explore the different advisory fee models.

Even though different advisors prefer different billing structures, one thing is clear – commissions are on their way out. Of the top 25 broker-dealers surveyed by InvestmentNews, fees made up 54% of revenue, while commissions made up 34%. In 2013, the reverse was true: commissions made up 52% of revenue and fees 34%.4

Advisors are seeing the potential benefits of fee-based billing models

One reason advisors aren’t hesitating to adopt fee-based structures is because when it comes to performance, alternative fee structures are shown to perform just as well, if not better than traditional models. In a study of pricing models from 2013 to 2020, RIA advisory firm Herbert & Company found that from retention rates for AUM clients generally stayed around 95% or higher.5 In addition, the broker-dealers surveyed by InvestmentNews reported more than 50% of their revenue came from fees for the first time in 2021, while posting record revenues of $33.9 billion.4

Clients prefer fee-based and subscription billing

Clients are willing to adopt fee-based relationships with their advisors and even favor these payment structures. A full 61% of the households surveyed by Cerulli preferred to pay for their advice via a fee, compared with 39% that preferred commissions.6

As advisors move to fee-based pricing, there’s yet another shift underway. Consumers today are accustomed to paying subscriptions for streaming services, rideshares, software, food delivery, and more. Beginning with Charles Schwab in 2019, investment firms started giving consumers the option of paying for financial planning via subscription, and many investors gravitated toward this new service model.7

Advantages of subscription-based billing

Consumers often cite convenience and cost of service as reasons to subscribe to a service, and a subscription for financial planning services can provide both.8 In addition to having a better understanding of what services they’ll be receiving, a subscription can offer a convenient way for consumers to maintain that service, and even be more cost-effective.

After all, the AUM model isn’t ideal for all investors, especially those who are younger and haven’t had the opportunity to accumulate enough savings. The latest Changes In Family Finances report from the Federal Reserve reveals that 80% of U.S. households have a median net worth of $307,000 or less.9 As a fee of 1% would produce revenue for a wealth advisor of just $3,100, it’s not surprising that many firms prefer to compete instead for the smaller twenty percent of U.S. households with a higher net worth.

A subscription model, however, could fill in the gaps, enabling advisors to serve more U.S. households and build relationships with younger clients that progress in their higher earning years. Some advisors start with a subscription model until clients reach a certain wealth level or experience a significant life event, and then transition to a fixed fee or AUM fee.

Subscription-based advisors can set up strategies for giving their clients ongoing, meaningful advice on taxes, buying their first home, saving for kids’ college, choosing life insurance, and more. This suits many of today’s clients, who prefer to work with an investment professional that can holistically address financial needs across investments, taxes, banking, and budgeting.1

Advisors don’t have to be locked into either subscription or fee-based billing. Firms offering financial advice and portfolio management for their clients might find a hybrid pricing structure attractive. For example, a firm might maintain its AUM fees but offer the advisory portion as a value-added subscription.

Leveraging fee-for-planning billing technology

As advisor pricing structures become more complicated, having an easy-to-use and scalable billing solution is critical. At Envestnet, we offer both AUM and subscription fee billing solutions for advisors.

BillFin, our cloud-based advisory billing software, supports a variety of pricing structures, including flat, tiered, and banded AUM fees. With BillFin, you can set firm-level, household-level, and account-level asset class, or individual security exclusions, for complete control over how, what, and when your clients are billed. You can also customize your invoices to match your branding while clearly indicating what’s being charged, limiting confusion and helping to meet state-registered firm requirements.

Envestnet Payments equips advisors with the ability to offer flexible subscription, hourly, and retainer fee options, create and distribute invoices, and securely process credit card and ACH payments. The advisor dashboard provides insight into your book of business, including collected fees, upcoming fees, and more. For easy subscription billing, Envestnet Payments automatically creates client invoices for recurring subscriptions that identify the services and fees charged.

Because an advisor’s success is ultimately tied to their clients’ success, the industry is starting to move toward transparent fee-only and subscription-based pricing models. As you seek to build long-term trust and demonstrate the value you provide to clients, it’s well worth considering fee-only and subscription-based pricing models. Once you start leveraging these models, you may never want to return to traditional pricing again.

Explore our Fee-Only vs. Subscription-Based Pricing report and get a free trial of Envestnet Payments.