Bank Data Platform

An ecosystem of data and analytics to drive growth for banks and financial institutions.

Take data-driven action to engage and retain customers, pursue primacy, and grow AUM

Banks and financial institutions are looking for ways to differentiate themselves to retain their current customers and acquire new ones. The Bank Data Platform from Envestnet® Data & Analytics goes beyond traditional core capabilities of data aggregation and account verification. It provides insights and intelligence to help gain a competitive advantage, grow, and innovate.

Learn more

Data connectivity that fuels intelligence and analytics

Get the full picture

Get a greater picture of client finances with both held- and held-away account data.

Engage customers

Provide customers with data-driven insights that are more timely and personalized.

Activate data

Guide decision-making with data-driven intelligence to help improve productivity.

See Opportunity

Surface opportunities to grow revenue and deepen customer relationships.

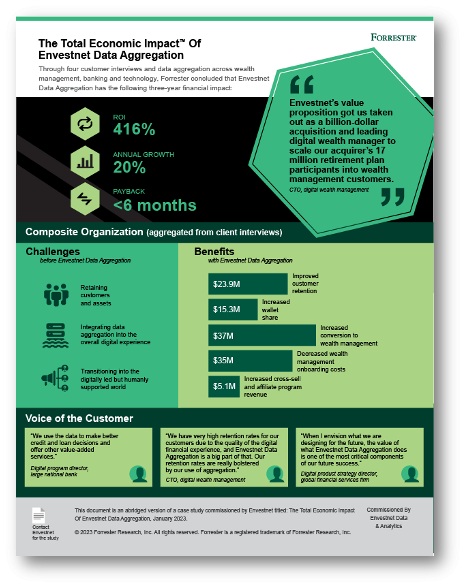

The Total Economic Impact™️ of Envestnet Data & Analytics Data Aggregation

In this report commissioned by Envestnet from Forrester Research, the total economic impact of Envestnet Data Aggregation was investigated. In it, they assess the benefits, costs, and risks associated with the investment. The analysis revealed participants realized an average of 416% ROI over three years, 20% annual growth, and payback in under 6 months. **The Total Economic Impact of Envestnet Data Aggregation, January 2023. Forrester Research.

Request the report

Envestnet named an open banking intermediary leader

Envestnet has been named a leader in The Forrester Wave™: Open Banking Intermediaries, Q1 2023 report. The report recognizes Envestnet for market-leading depth in data aggregation and as an open finance player that unifies multiple sectors within financial services to offer true open finance. Read the report to learn more about Envestnet’s superior product vision and execution roadmap.

Request the report

At Envestnet we offer a Financial Wellness Ecosystem to help your clients live an Intelligent Financial Life. Through our data intelligence tools, you have everything you need to deliver innovative digital offerings and actionable recommendations.

Learn moreA new era of intelligence

Achieve digital transformation by partnering with a leader

- 19K+data sources

- 400M+linked consumer accounts

- 38M+paid users

- $5.8T+total platform assets

- 700K+fintech companies

- 16/20 largest U.S. banks

Transform your data challenges into growth opportunities

Held-away data

Provide new offers based on your existing and held-away data.

Insights

Personalize experiences using non-traditional insights to better segment customer needs.

Enrich data

Use data enrichment to help consumers more easily recognize transactions.

SMB customers

Better serve your SMB customers with a dedicated portal for their financial data.

Lending

Speed up the lending process and better manage risk with current analysis.

AI-driven intelligence

Accelerate decision-making at the firm and consumer level with AI-driven intelligence.

Dynamic views

Access dynamic views into deposit flows in your bank and in peer banks.

Platform solution

Implement a bank platform solution without the expense and time of an internal build.

Learn more

* Required Field

Want to learn more?

Let’s discuss how Envestnet's Bank Data Platform can help support your business with data connectivity, analytics and intelligence, and experiences to support an Intelligent Financial Life for your customers.

Put the Bank Data Platform to work for you

-

Data sheet

Envestnet Bank Data Platform: Creating Opportunities for Decisive Action

The Data & Analytics platform architecture features flexible and modular components so you can deploy solutions that drive revenue and provide targeted services to your customers.

-

eBook

SMB Success: Tapping Into the Hidden Potential of Small to Mid-Sized Businesses

Financial institutions have unique relationships with small to mid-sized businesses (SMBs). Years of support, and sometimes even side-by-side collaboration, naturally position banks as trusted partners.