Trading tools

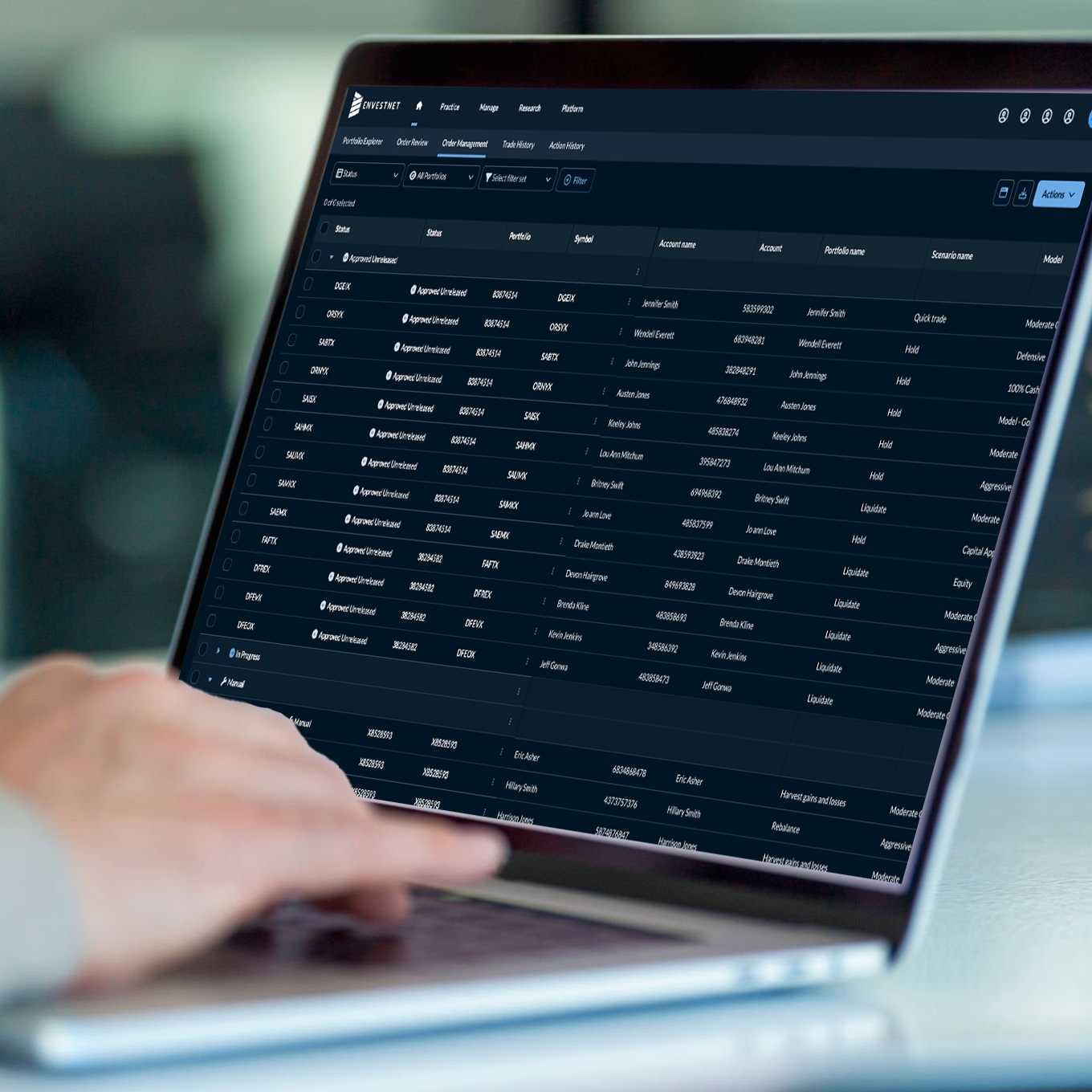

Envestnet offers modern trading tools to enhance productivity throughout the investment lifecycle.

Centralized, flexible capabilities

Envestnet offers an open architecture approach to help meet your trading needs and deliver portfolio management and trading solutions across all market segments and personas. Our powerful trading products within the Envestnet Wealth Management Platform power advisors' practices through efficiency and scalability.

Configured to your firm’s needs

We provide firms with the scalability needed to manage large volumes of accounts efficiently with deep integrations and a selection of custodial platforms. Leverage our highly flexible configurations, trading capabilities, and compliance tools built to help advisors provide high-quality financial advice for their clients.

Our trading experience has evolved to provide flexibility and efficiency to your trading workflow.

Model management, account monitoring, trading, rebalancing, and reconciliation in a flexible, scalable product.

Explore your Trading options

No matter how you run your business, Envestnet can meet you there. Our trading options, combined with their configurability, allow you to trade how you want to in a productive, efficient way. Learn more in our Trading tools comparison brochure.

Explore the potential impact of Envestnet's powerful Trading technology on business efficiency and productivity.

Connect with UsDelivering portfolio management and trading solutions to all market segments

Envestnet offers options for any trading workflow setup, ensuring your business and clients have the functionality that they need. We support multiple trading programs, providing the flexibility necessary to meet your business needs.

Advisor as Portfolio Manager

The advisor owns most or all of the trading execution. Tamarac users experience this program type.

Home Office/Sponsor Trading

The advisor is handling proposals and bringing in new business, while trade execution is handled by a team of designated traders.

Outsourced Admin Trading by Envestnet

Envestnet handles all or most of the trading execution on behalf of the home office and advisors.

A leader in the industry

**As of March 14, 2025.

Envestnet offers 80+ Investment Policy configurations

Help advisors stay within guardrails where you can set user permissions, rights, and roles. Learn more about consulting for your high-net-worth clients? Envestnet can help deliver high-quality trading experiences for advisors with HNW clients.

Blog

Realizing the vision for a different kind of advisor experience

Pure Financial delivers white-glove service with the help of Envestnet tools and support.

Stay connected with all things Envestnet

Join our quarterly digest highlighting Envestnet’s technology updates.

Insights for Trading

-

Article

Analyzing Q3 2024 active and passive asset classes

Our ActivePassive Scorecard shows active funds beating their category benchmarks in three of the 19 asset classes we tracked for the first quarter.

-

Article

Direct indexing as a core element in ActivePassive strategy

Direct indexing enhances portfolio customization in an ActivePassive strategy. It combines passive core stability with active investment opportunities, offering personalization, tax optimization, and flexibility.

-

Article

4 reasons bond ladders can be effective direct indexing strategies

The concept of direct indexing can also be extended to bond portfolios, including through the use of bond ladders.

-

Article

Positioning client portfolios to win with Rick Rieder, BlackRock

Life can be good for investors right now, particularly in fixed income, as long as advisors keep some important caveats in mind.