The result is a demand for financial advisors to be more conversant with, and well positioned to, provide guidance and services for clients regarding how to manage their everyday cash management and lending needs.

This is not new for the truly holistic wealth manager. Yet until now, many advisors have been reluctant to be truly proactive in supporting cash management and lending solutions, leaving many of these services to the side as a reactive accommodation, to be utilized only if a client specifically requests them. Or the advisor defers to the banks, which are now competing with them more strongly than ever for the most profitable relationships.

83% of clients expect loan and credit advice from their advisor. Only 3% felt they actually received that service.1

Clients are demanding cash management and lending solutions as a critical component to meeting their financial goals and macroeconomic conditions are amplifying the need more than ever. Advisors who continue to ignore these core client needs will ultimately lose business to those that do.

RIAs haven’t been quick to adopt liquidity products

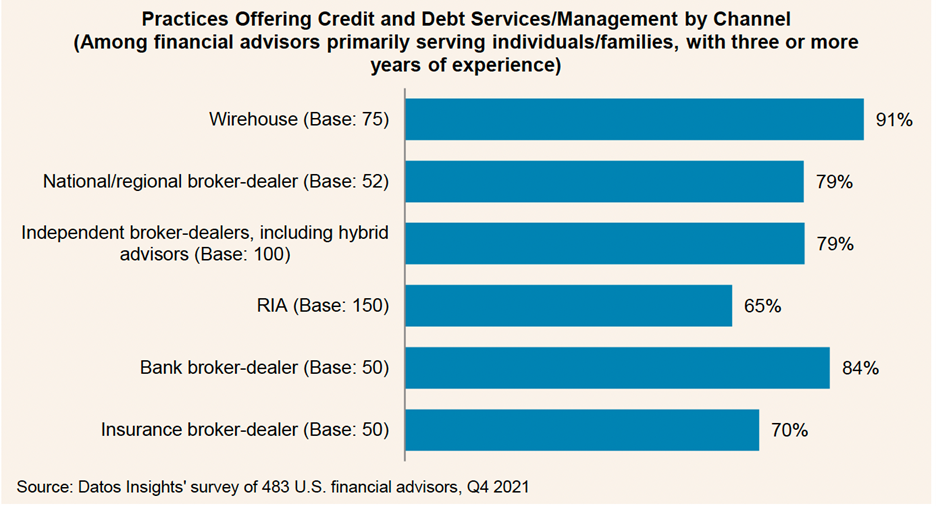

A Datos Insights report highlighted that RIAs are lagging behind other groups in offering liquidity products to their clients.

This is surprising, given client expectations and the general push in the industry to deliver holistic advice. In the report, Datos researchers dig further to identify why advisors don’t actively offer credit solutions to their clients more often and why clients don’t ask for it. There seems to be a simple disconnect in communication over what is available and also how easy or hard it is to leverage credit products to achieve positive client outcomes.

In my view, advisors need to provide their clients with a selection of services and a selection of quality providers in an efficient manner. When an advisor can provide cash management capabilities (addressing the client’s flow of incoming and outgoing funds) that advisor is directly involved in the daily financial life of his/her clients.

In addition, when a client has a significant funding need and does not want to liquidate investments, potentially derailing the investment/financial plan already in place, being able to offer a selection of loans/financing options also becomes essential. The ultimate goal here is for advisors to have access to a broad range of loan types (asset-based or unsecured) from high quality lenders to meet their clients’ personal and business credit needs.

Cash and credit management solutions in the market today

Financial technology can make it easier for advisors to substantially expand the suite of solutions available to their clients, ultimately enhancing their business and delivering better outcomes for clients.

Envestnet’s Credit Exchange powered by, Advisor Credit Exchange (ACE), was recently featured in the Datos Insights report, “When Banks Dial Back Lending: Wealth Managers Have Solutions to Fill the Gap.” The ACE platform puts a broad selection of cash management and lending solutions available from high quality providers at an advisor’s fingertips. The Datos Insights report highlights ACE for having taken the next step beyond providing the technology for supporting cash and credit solutions—They’ve also built a four-layer support infrastructure to ensure advisors and RIAs can successfully implement the solutions.

Research, like that from the Spectrum Group and Datos, shows us that clients want more from their advisors. As technology makes it easier to deliver on those expectations, we expect more and more advisors to offer cash management and credit services to their clients.

To learn more about delivering a more holistic wealth management experience and provide advice-driven liability management solutions to help clients manage both sides of the balance sheet, please contact the ACE Advisor Sales Team at 844.259.2223 or rlmteam@advisorcreditexchange.com.