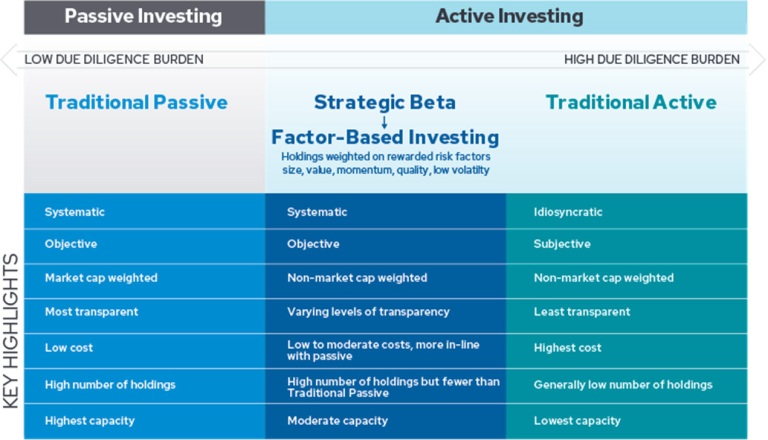

Factors, also called strategic betas or smart betas, are sources of systematic return that can be isolated through quantitative analysis. Some examples of the most well-known investment factors are Value, Momentum, Low Volatility, Quality, and Size. These factors have been found—through decades of academic and industry studies—to drive returns that were previously thought to be idiosyncratic, and this research has led to the creation of portfolios that emphasize one or more factors. The ETF structure can provide a useful vehicle to implement factor-oriented strategies because it can offer flexibility and tax efficiency. For example, the S&P 500’s constituents could be evaluated from a factor perspective, and an ETF could be constructed to capture exposure to, or “tilt” toward, the Value and Momentum factors. More complicated factor exposures could be crafted, too.

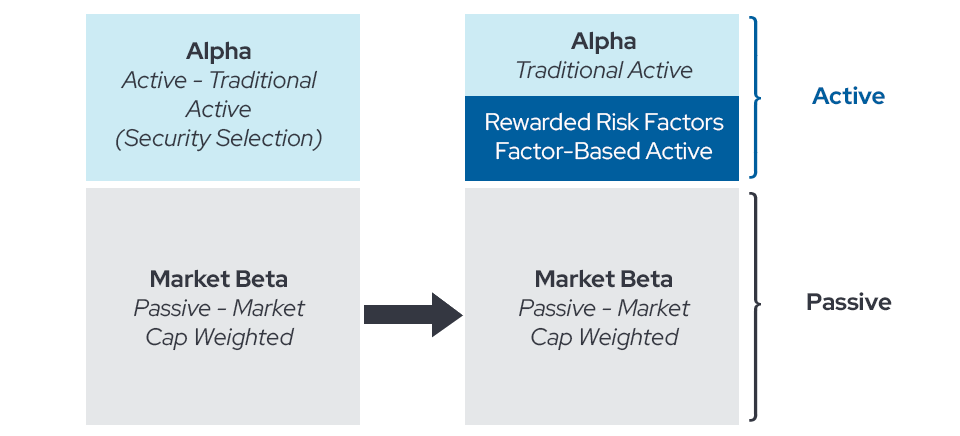

At Envestnet | PMC, we consider factor-focused funds to be actively-managed since they aren’t designed to deliver the returns of major benchmarks. These strategic beta funds aim to deliver alpha or achieve a certain objective. In our view, active management encompasses all strategies that deviate from attempts to track market capitalization-weighted indices.

The factor ETF marketplace

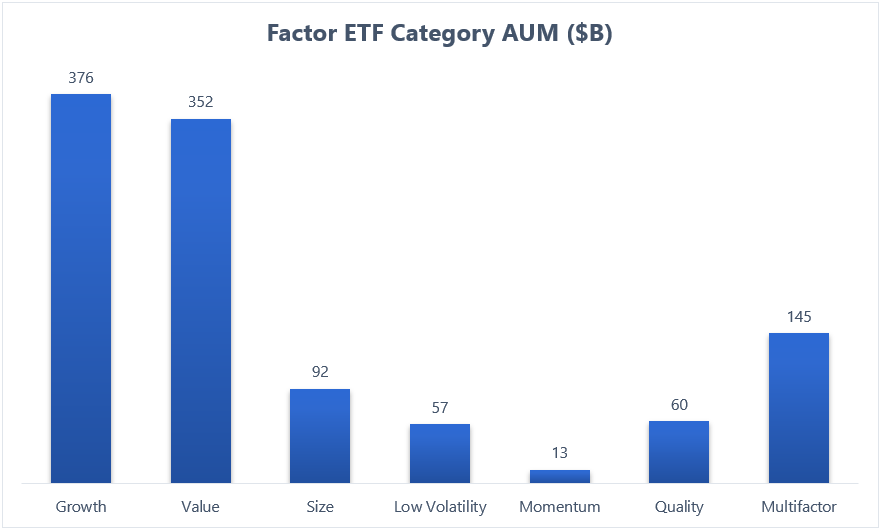

As of October 31st, 2023, approximately $950B was invested in ETFs centered on one of these critical factors: Growth, Value, Momentum, Low Volatility, Quality, and Size.1 Another $145B was managed in Multifactor ETFs.2 These figures illustrate the popularity of strategic beta ETFs, although these smart beta categories only represent around 15.5% of total ETF assets. The proliferation of new factor ETFs has dipped over the past couple of years, but this fund category remains well-stocked with products.

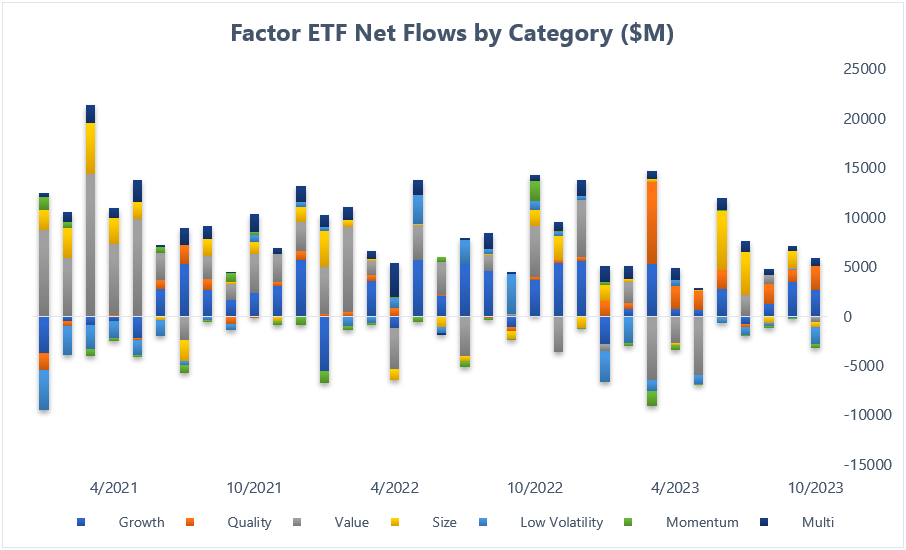

When we look at flows, we see that factor ETFs have only suffered net outflows in two months since the start of 2021. This fact may illustrate that investors and their advisors continue to find these funds compelling, despite market turbulence.

Factor performance update

The performance of factors can significantly impact traditional active manager success, especially because factors are deeply intertwined with investment approaches and styles. Rewarded risk factors are also widely recognized as fundamental components of equity returns, as noted earlier. Envestnet | PMC believes that the most robust among the studied risk factors are Value, Momentum, Quality, Low Volatility, and Size. Like all return components, though, factors are cyclical in nature.

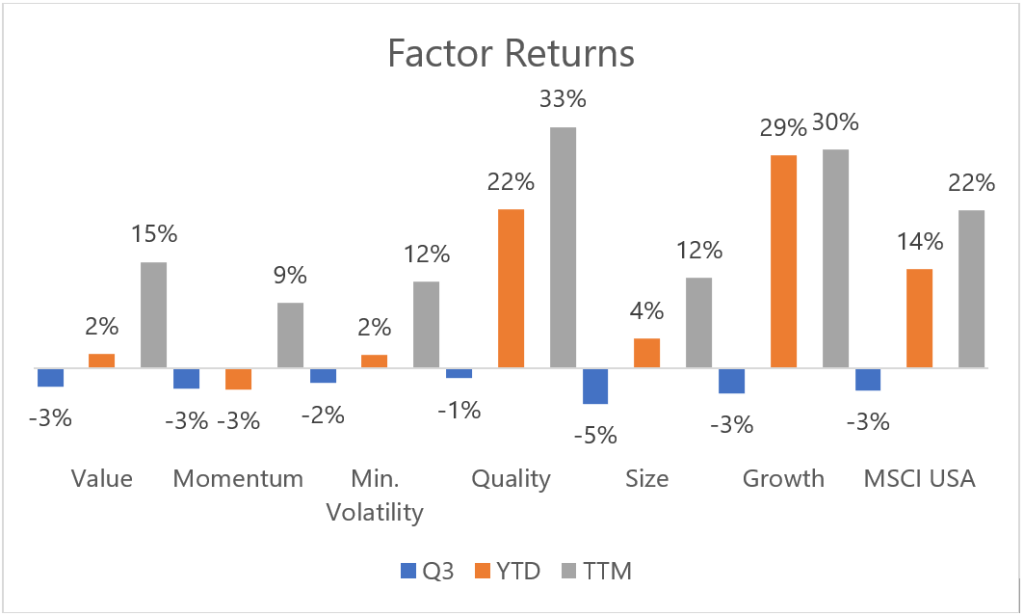

Below, we examine the performance of six factors in the current market environment. (Note that the Growth factor can be viewed as the inverse of the Value factor in its construction.)

- All the factors that we tracked for this post declined in the third quarter, illustrating the breadth of U.S. equity market weakness during the quarter. Factor performance is also cyclical, just as it is for all assets, as factors bear the effects of both the macroeconomic, business, and sentiment cycles. As building blocks of equity returns, the case for factors over the long-term remains unchanged, but factor-driven investing requires patience to ride out these short-term cycles.

- Quality was the best-performing factor last quarter, while Size was the laggard. Small cap companies are facing pressure from higher interest rates, but the strong businesses distilled into the Quality factor may be able to weather rising rates better.

- Year-to-date, Quality and Growth are the strongest factors. Growth has shown a strong rebound from last year, but Momentum is the YTD straggler. The return of strong Growth performance following a year when Value excelled has been detrimental to the Momentum factor.

- Over the past year, Quality is the bigger winner while small cap stocks, represented by the Size factor, have struggled. Big tech stocks are becoming increasingly associated with the Quality factor, and they have performed well this year.

The opportunity

Factors represent distinctive characteristics of securities (typically, but not always, in equities) that can be isolated through mathematical processes. Stocks that rank highly in one or more factors can be blended into portfolios for ETFs to make factors investable. Although traditional actively-managed mutual funds are bleeding capital, factor ETFs have steadily accumulated flows. The systematic processes, generally reasonable fees, and flexibility of these ETFs have attracted meaningful capital in recent years. As money likely continues to exit traditional active mutual funds, factor ETFs may be a compelling alternative for advisors seeking a modern way to potentially earn alpha.

For more information on Envestnet | PMC,

please visit www.investpmc.com.