It's amazing that managing clients' taxes doesn't have to be so complex.

Get our 4 Tips for Managing Capital Gains Taxes

Taxes can often be a client’s biggest expense—manage all of their tax liabilities with a tax overlay solution, so you can deliver tax efficient strategies and happier clients.

Chances are you'd rather spend your time working with clients than working on their taxes.

Envestnet's Tax Overlay service helps you provide clients with tax efficient strategies:

Customize to each client's situation.

Provides ongoing monitoring of client accounts.

Manages your clients' taxes—while you manage their investments.

Neither Envestnet, Envestnet | PMC nor its representatives render tax, accounting, or legal advice.

44%

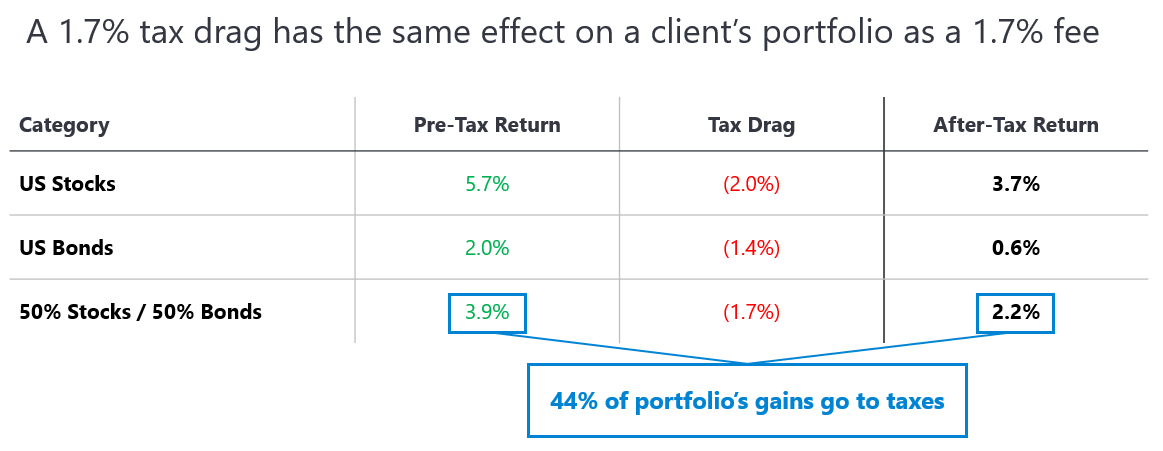

44% of Portfolio Gains Could Go to Taxes

—But They Don't Have to

Envestnet's Tax Overlay service helps manage tax drag and facilitates tax efficient investing.

Source: Morningstar. For illustrative purposes only. Data as of 12/31/2018. Assumes a portfolio holds 50% US stocks and 50% US bonds. US stocks, represented by the Morningstar US Equity Mutual Funds category, had a pre-tax return of 5.7% and after-tax return of 3.7%, with a tax drag of 2.0%, in 2018. US bonds, represented by the Morningstar US Taxable Bond Mutual Funds category, had a pre-tax return of 2.0% and after-tax return of 0.6%, with a tax drag of 1.4%, in 2018. The total portfolio had a pre-tax return of 3.9% and after-tax return of 2.2%, with a tax drag of 1.7%, in 2018.

Source: Morningstar. For illustrative purposes only. Data as of 12/31/2018. Assumes a portfolio holds 50% US stocks and 50% US bonds. US stocks, represented by the Morningstar US Equity Mutual Funds category, had a pre-tax return of 5.7% and after-tax return of 3.7%, with a tax drag of 2.0%, in 2018. US bonds, represented by the Morningstar US Taxable Bond Mutual Funds category, had a pre-tax return of 2.0% and after-tax return of 0.6%, with a tax drag of 1.4%, in 2018. The total portfolio had a pre-tax return of 3.9% and after-tax return of 2.2%, with a tax drag of 1.7%, in 2018.

Tax Management FAQs

What is tax loss harvesting?

Tax loss harvesting means selling investments at a loss to offset any capital gains that have been realized throughout the year.

What are tax efficient strategies? Understanding where to place your investments starts with understanding their tax efficiency. Tax-inefficient investments can be placed into qualified accounts to minimize their taxes, while more tax efficient investments can be placed into nonqualified accounts.

What is tax overlay and how can it help me offer tax efficient strategies? Tax overlay services continuously address holistic needs around tax management, while maintaining the strategy of the client’s portfolio. It goes beyond tax loss harvesting, as it models the tax impacts of all trades specific to the client’s situation to optimize after-tax returns.

Inside the Intelligent Financial Life:

Spend more time on what matters

No one likes dealing with taxes—but it's one of those tedious tasks that just has to get done. Tax management goes beyond just year-end tax loss harvesting. If you don't consider the tax implications for your clients' portfolios year-round, you may be leaving money on the table. Envestnet's Tax Overlay can help protect your clients' capital gains and make a difference in managing their portfolio.

Learn more about how our

Tax Overlay service can enhance your value to clients.

Tax Overlay service can enhance your value to clients.

Why Tax Management Matters

See how tax efficient strategies may directly impact your clients' portfolio returns.Watch the Overview

sted

sted