In today’s complex market environment, leading Registered Investment Advisors (RIAs) address their clients’ changing needs with holistic and personalized advice. To do this, many focus on growing their businesses using managed accounts and customized solutions that align with clients’ unique preferences. At Envestnet | Tamarac, we offer access to two rapidly expanding options: Unified Managed Accounts (UMAs) and Sustainable Investing.

Deliver personalized portfolios with Tamarac Unified Managed Accounts

Research has shown that 70% of wealth management clients view highly personalized service as a factor in deciding whether to stay with their current advisor.1 Our UMA solution, a separately managed account SMA/UMA administration platform, allows RIAs to consolidate the management of SMAs and UMAs and automate services you may be handling manually today. In doing so, it unlocks opportunities to personalize portfolios and deliver more integrated advice.

There are three primary reasons why advisors find UMA solutions appealing:

- Consolidation

UMA technology consolidates multiple portfolios from various managers into a single account. Instead of employing multiple accounts with different solutions for a single client, it centralizes all assets into one account, effectively managing various goals and addressing different issues. - Efficiency

UMAs reduce operational overhead and drive efficiency so you can get more time back in your day. And with multiple managers within the hood of one account, Envestnet | Tamarac efficiently coordinates the trading, giving you more time to focus on clients. - Customization

The UMA solution offers access to Envestnet | PMC’s Impact Overlay service, which allows for greater customization, including the option to align with your clients’ values, beliefs, and goals through sustainable investing.

The use of UMAs nearly doubled from 2017 to 2019, and over the same period, the use of SMA strategies in a UMA format increased by over 125%.2

Add value to your practice with sustainable investing

Financial advisors are expected to deliver comprehensive and holistic investment advice, encapsulating not only their client’s financial and risk objectives, but also their life goals, passions, and values. Sustainable investing offers a great avenue for advisors to incorporate those life goals, passions, and values into their clients’ investment portfolio, providing a more curated portfolio to help meet their clients’ needs and expectations.

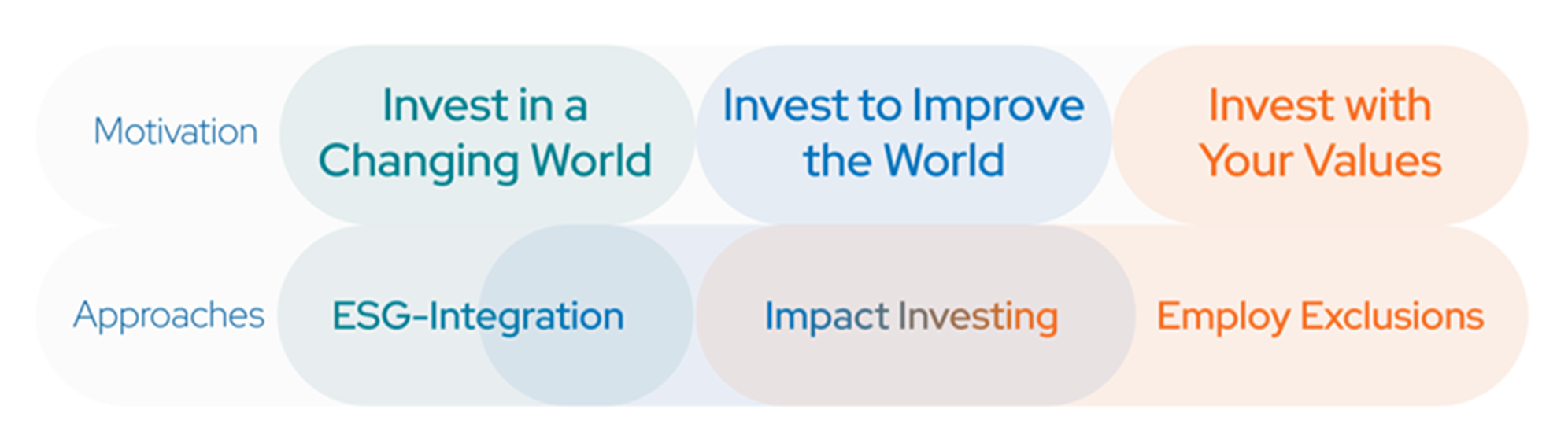

Sustainable investing encompasses a spectrum of investment approaches that can be deployed based upon the motivations of the investor. Given the very nature of this customization, there is no such thing as “one size fits all” in sustainable investing. Instead, advisors can leverage one or all these approaches in conjunction to meet the very unique needs of their clients. Envestnet offers the following framework for the various client motivations and the associated investment approach or tactics.

When it comes to addressing clients’ diverse needs, many advisors see sustainable investing as a way to elevate client relationships through the creation of personalized portfolios, while potentially unlocking new avenues for business growth. Here are three key reasons why advisors choose sustainable investing:

- Compelling business opportunity

Being able to offer tailored and personalized investment advice to existing clients can pave the way for business growth. It can also enhance your ability to attract new clients. - Deeper client engagement

Gaining insight into your client’s values and improving your understanding of their goals has a twofold effect: enhancing asset stickiness and magnifying possibilities for cross-selling. Equally vital is the establishment of strengthened loyalty and the attraction of clients with a long-term mindset, both of which can contribute to the sustained growth of your business. - Better portfolios, better outcomes

Research shows that incorporating sustainable information into the investment process can help deliver competitive performance.3 In addition to competitive performance, sustainable investing offers an opportunity to unlock and deliver value through exposure to emerging and innovative investment themes.

The Envestnet platform has more than $40 billion in sustainable AUM/A (as of 6/30/23) and over 600 investment solutions available on the platform with a sustainable attribute.

Enhance your offering with Envestnet

Envestnet is here to partner with you through a flexible and customized service model. Our sustainable investing technology offering is entirely complimentary for Tamarac users, giving you access to a wide range of resources, tools, and solutions. We assist you with an advisor portal, education, and training, enabling you to craft personalized portfolios that reflect client preferences. Our customized service model offers 1-1 consultations, portfolio construction support, product offering reviews, and actionable insights empowered by Envestnet data.

For more on our sustainable investing tools and resources to assist you in delivering personalized portfolios that align with both financial and sustainable goals, contact us at sustainable@envestnet.com.

The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Implementing sustainable investing strategies will reduce the universe of investment options available. This may have a positive or negative effect on investment performance relative to strategies which do not utilize sustainable investment methodologies. While our tools are designed to help advisors understand and implement the expressed preferences of their clients, this may not be possible in all situations due to inherent limitations on available data and investment options.

All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. This material is not meant as a recommendation or endorsement of any specific security or strategy.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.

Envestnet | Tamarac, a division of Envestnet, Inc. (NYSE: ENV), is leading provider of integrated, web-based portfolio rebalancing, performance reporting and customer relationship management software for independent advisors and wealth managers.

Any advisory services discussed herein are provided by an affiliated entity, Envestnet Asset Management Inc., an SEC Registered Investment Adviser.

1 2018 Gartner report titled, “Predicts 2019: Marketing Seeks a New Equilibrium”

2 Cerulli Edge, 4Q 2019, Issue #74; Page 8

3 New Meta-Analysis From NYU Stern Center for Sustainable Business and Rockefeller Asset Management Finds ESG Drives Better Financial Performance, 2021