In 2020, there was an estimated 6.6 million high-net-worth investors (HNWIs) in the U.S. By 2025, that number could increase by 33% to more than 8.8 million.1 The population of HNWI is growing, and with the right approach and the right tools, more advisors can take advantage of this compelling opportunity.

Of course, attracting HNWI comes before retaining their business. To that end, we recommend a three-pronged marketing approach:

First, set yourself up to succeed by gaining a deeper understanding of the needs of HNWI, why they may or may not want to work with you, and how you can provide value beyond their own skills and resources.

Second, choose a segment to serve. Marketing professionals will often say “if you are speaking to everyone you are speaking to no one.” Your practice is likely best positioned to serve a specific type of client. Identifying that group increases your chances of success.

Third, attract your target clients to your practice by being easy to find and by sharing relevant content. Ideally, you’d like your target clients to understand your expertise and at least some of the value you can provide before you even meet them.

1. Understand HNWI needs & objections

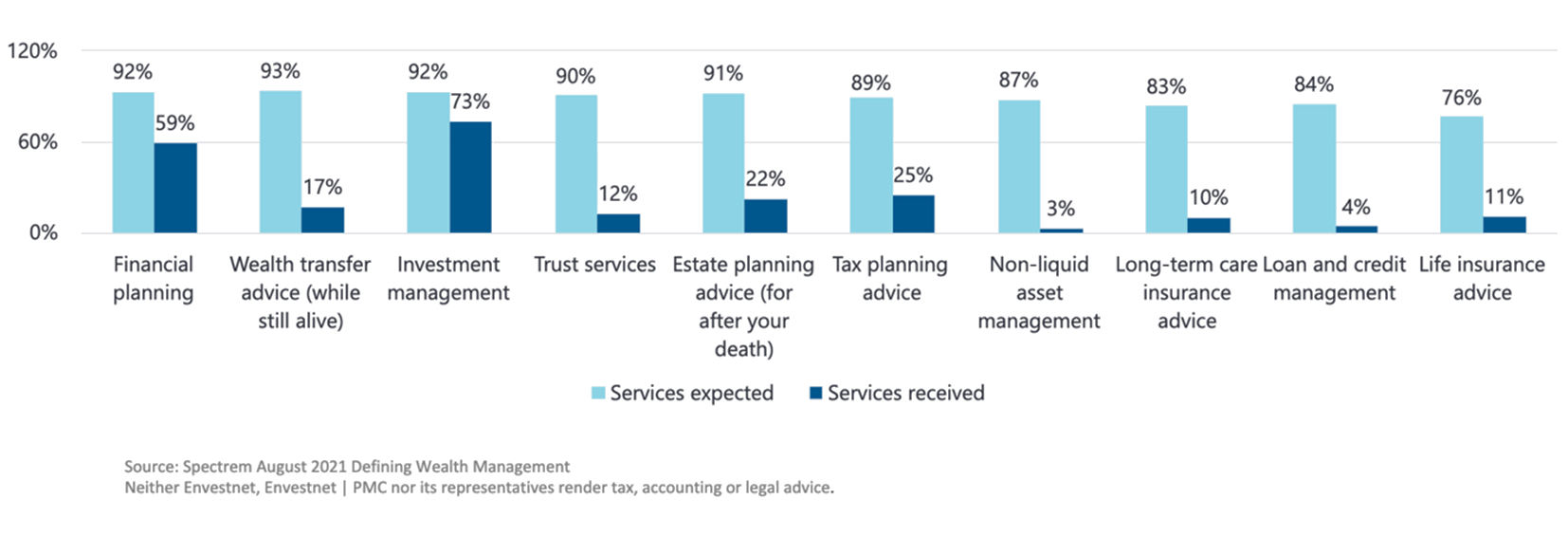

HNWIs are high-touch clients with diverse needs and resource requirements. Research shows significant gaps between client expectations and the services they receive. Providing the services that HNWI are looking for is a key way to secure their business.

The gap: Services expected from advisors vs. services received

- Estate planning support: Tailored strategies to minimize taxes and ensure smooth wealth transfer.

- Strategic tax planning: Proactive approaches to optimize tax efficiency and preserve wealth.

- Comprehensive insurance solutions: Protection across assets and lifestyle with tailored insurance products.

- Customized credit management: Strategic credit options and guidance for wealth enhancement and liquidity.

In future posts, we’ll take a closer look at the technology, solutions, data insights, and services available to advisors serving this population of clients. But overall, the chart above shows that HNWI are looking for a highly tailored and comprehensive experience, closer to what it might feel like to have their own family office. Utilizing a “family office-like” approach helps HNWIs to feel fully supported and also helps them to see the value that you provide.

Being able to articulate your value is particularly key for HNWI. Our research found that 59% of HNWI do not plan to hire a financial professional. Many would prefer to manage their own wealth and struggle to justify the expense of paying someone else to do it.2 This makes sense when you consider that 88% of millionaires are self-made and likely seasoned business professionals, according to a recent Fidelity survey.3 Our research found that 80% utilize their own income and savings to achieve their wealth.4 Considering that they’ve come so far on their own, can you present a clear business case for why they should work with you?

72% of HNWI would expect to pay their advisor $5,000 or less annually.5

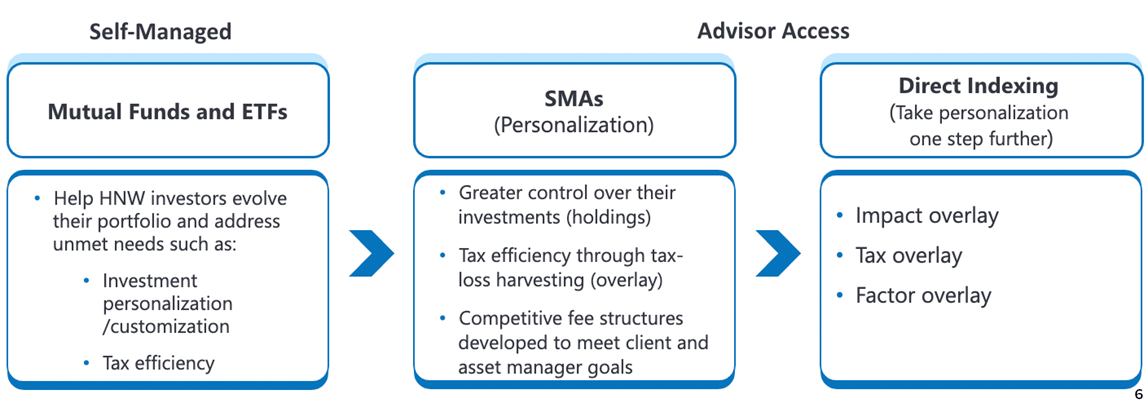

It is vital to be able to clearly articulate and demonstrate the value that you provide from your very first conversation with a client. One way to do that is by highlighting the sophisticated investing tools that you have access to and the customized strategies you can provide— tools and options unavailable to individual investors on their own.

To put your messaging all together…HNWIs have a broad range of needs and you are uniquely positioned to comprehensively address them. They should work with you because you can offer sophisticated solutions, expertise, and support that they are unable to access on their own.

2. Consider underserved segments

Specialization can be a powerful way to grow your book of HNWI. There are things that your practice does uniquely well. By pairing those skills and resources with clients who have a strong need for them, you set yourself up to have deeper, stronger client relationships.

Within the broader group of HNWI are many different subsegments, many of whom are underserved. These groups are hungry for financial professionals who understand their needs and are equipped to address them.

Here are just four examples of underserved HNW segments:

- HENRYs (high earner, not rich yet)—Positioned to become affluent members of society, typically around 43 years old with incomes exceeding $100,000 and investable assets below $1M.

- Women — Women are set to inherit 70% of global wealth over the next two generations. They seek firms offering fee transparency, data security, and education on wealth growth.

- Tech-wealth —The tech boom has led to a rise in tech-wealth HNWIs, yet only 27% of wealth management firms actively pursue them.

- LGBTQ+ — 62% of LGBTQ+ respondents said their unique needs around complex issues such as adoption and estate planning has caused them to experience financial challenges. They are actively seeking advisors who can help them navigate these topics.

There are many more segments to consider. Observe your local community and consider which groups you might fit into yourself.

3. Be easy to find

If your ideal HNW client decided to look for an advisor today, would they find you? Would they understand right away that you are the perfect advisor for their needs? Being easy to find both online and in your community is critical to attracting busy HNWIs to your practice.

As you think about your marketing mix, consider:

- Online presence—On your website and social media platforms, is it clear what you do and how you can help HNWI? Are you sharing content that is relevant to your target segment?

- Paid opportunities—Have you considered paid online advertising, local or regional print media advertising, sponsorships, etc.? Focus on highly targeted opportunities that speak directly to your target clients.

- Event participation—Participation in carefully selected events or hosting thoughtful events can be a great way to reach potential clients of all types. Select the situations best suited for your target clients and your business needs.

Connection is key

As we mentioned above, many HNWI are savvy business owners. No one piece of the conversation is enough. HNWI need to know that you understand their unique needs, you have the expertise, experience, and resources to address those needs, and that you’ll deliver value. That full narrative is what builds trust and earns their business.

“If people like you, they’ll listen to you. But if they trust you, they’ll do business with you.”

Zig Ziglar, writer and salesman

We’re here to help. Whether you’re an independent advisor, a broker-dealer, or an institutional investor, Envestnet | PMC provides you with all the experience and solutions you need — from comprehensive manager research to portfolio consulting and portfolio management — to help you efficiently support your HNW clients and grow your practice.

Envestnet’s Private Wealth Consulting service can help you prepare to serve HNWI. Visit https://www.envestnet.com/private-wealth-consulting to learn more.