I had the opportunity to speak with Greg Bartalos, editor in chief of Barron’s Wealth & Asset Management Group at FutureProof 2023 about Envestnet’s momentum, the future of wealth management, and how advisors can stay relevant as our industry continues to evolve. I’ve spoken about Envestnet’s origin story many times before, but I’d like to take a step back and expound on where we are headed in the future.

The innovation cycle

While a portion of our industry is still practicing what I would call a “plan-based” advice model, I think we can all agree that this industry is moving toward a more holistic future. Let’s think about what that looks like and where our industry is going.

In our discussion, Greg made a great analogy: In some ways a financial advisor is like a doctor. If you go to a doctor, they might give you one drug to treat high blood pressure, but there might be side effects to that medication that could affect another aspect of your overall health. So, a good doctor has to evaluate the whole picture—your body, what you put into it, your environment, what activities you hope to accomplish in the near and far future, how your family history may fit in, etc. If the doctor only treats your blood pressure in a silo, it could cause more harm than good. When you apply the same concept to financial advice, it becomes immediately obvious that a holistic approach is a good idea. Sound financial advice should incorporate your clients’ whole life, not just one siloed aspect of their finances.

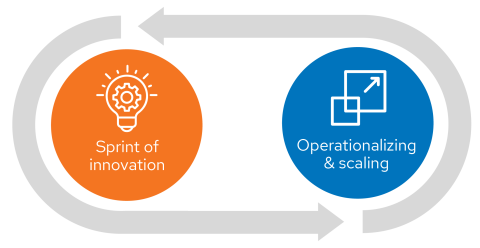

Having spent over 25 years in this industry, I’ve recognized a reoccurring cycle. We often see bursts of innovation, where new ideas are generated quickly—ideas that have the potential to change how we do business for the better. Following this phase of idea generation and selection, we enter a period where we need to operationalize the innovation and scale it. We have the new idea; now how do we actually do the thing? I believe that’s where many practitioners are at with the concept of holistic financial advice today.

All types of businesses run into trouble when they get stuck at any point on the continuum. Some companies are great at coming up with ideas, but stall at execution. Others execute really well, but then take the easier path of avoiding change rather than risking the disruption of innovation. I have found the most successful businesses, never stop moving through the cycle, balancing out both sides as much as possible.

The financial services industry seems to agree on the value in delivering holistic advice, but we’re still trying to figure out how to accomplish that with just 24 hours in a day.

No one wants to be left behind

Over the course of my conversation with Greg, he asked me, “how can advisors avoid being left behind?” He was of course referring to the rapid evolution of our industry, both from a business model standpoint and a technology standpoint. And it got me thinking.

What if the answer was truly as simple as two key steps an advisor can take to stay on top as our industry evolves? First, they can choose to see the opportunity. Embrace change for the better, even if it feels uncomfortable at first. See the opportunity in adapting and evolving with the industry not against it.

The second action advisors can take is to embrace technology, instead of ignoring its potential. Technology scales you. With greater expectations around personalization and more clients to serve technology is the tool advisors need to do that efficiently.

Today, we know that holistic advice is the innovation that is going to lead us into the future. Technology is how we operationalize and scale that innovation. Embrace that and you won’t be left behind.

Helping advisors to connect the dots

As we’re all aware, the Great Wealth Transfer is upon us. A large amount of money is transferring from one generation to another. There are two things I keep in mind about that wealth.

First, when the money transfers, it is landing in a digital environment. If we imagine the financial tools that baby boomers had at their disposal while they were building their wealth, the picture is very different from the digital world we live in today. We need to proactively acknowledge the difference to successfully serve the investors of today and tomorrow.

Second, it is important to remember the powerful emotional context surrounding each and every transfer of wealth, whether those emotions include grief, overwhelm, some excitement, nerves – the full spectrum.

Envestnet sees the advisor as sitting right in the middle of those two elements—the digital environment and the emotional context. The human advisor is helping to manage the digital financial platforms investors need, supporting them through their tough emotions, and connecting the dots of their clients’ financial lives.

A human financial advisor is essential because there are few things that are as emotionally charged as money. Financial advisors are indispensable in those moments. These can range from the moment when a new child is born into a family or when a loved one is lost too soon and the advisor is now supporting a new widower, widow, or an adult child of a lost parent or the day a business owner decides to sell their business. Those are the types of moments where a human financial advisor is a human first. And with the right tools at their fingertips, it’s when an advisor can help the investor to clearly understand all the elements of their full financial life so that they can make an informed decision about what steps to take next.

The opportunity to do good

Advisors have an incredible responsibility to act as stewards of an empowered, intelligently connected financial life. At Envestnet, we see money as the means, not the end of the client’s story. We help to enable money to be more helpful to more people, helping them to reach their goals. As an industry overall, we should recognize that the opportunity to scale our services is an opportunity to do a lot of good in the world.

“We can change the face of the industry to begin to render and reflect who America is, and serve more and more people with the services that help people live a better financial life. That is possible. And it’s possible because of technology, data, and education to provide more services to more people.”

We can help investors to be prepared

If we look at the markets today, cash looks good again and a lot of investors are choosing to sit back and wait this out. Before the markets shift, advisors can help their clients to be ready to move back out of cash. Uncertainty will always be there. That’s why human advisors play such an important emotional support role for their clients.

We can individualize advice at scale

We often discuss “scale” strictly in terms of how technology can help advisors better serve a robust book of business. But we can also choose to think about how delivering individualized service at scale can enable advisors to take on a wider range of clients. Not every client needs to be high-net-worth, if you are able to support them all efficiently. Improving the industry’s efficiency as a whole should enable more and more clients to be served.

We can move beyond stereotypes

Repairing the stereotype of all “financial professionals” wearing chalk striped suits has become a bit of a passion project for me. There are great career opportunities for all in the Fintech and Financial Services industries.

Our Envestnet Institute on Campus program was created to build a bridge between the college/university environment and the asset and wealth management industry, training talented students and better positioning them for employment. We all benefit from additional diversity.

This is such an exciting time for us all. Technology is going to be the key to how we effectively and efficiently operationalize holistic financial advice for the individual. We’re all in a position to benefit from that.

Discover the depth and breadth of Envestnet’s ecosystem at https://www.envestnet.com/our-ecosystem.

The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.