As the complexity of financial markets, tax laws, retirement and estate planning grows, so does the demand for holistic advice tailored to individual life goals. With advancements in financial planning technologies, advisors are now able to offer in-depth planning as a value-driven service rather than an added bonus. Charging for financial planning reflects its importance in delivering personalized, comprehensive strategies that go beyond simple investment management, ensuring long-term financial success for clients.

To better understand how advisors charge for planning, Envestnet | MoneyGuide conducted a web-based survey in 2023 of 600 advisors, including responses from Registered Investment Advisors, Independent Broker Dealers, and financial service firms. Our analysis shed light on the influence of advisor fees, helping advisors make informed decisions about their practice. Here are just a few of the key insights for advisors.

90% of advisors charge for financial planning

Advisors are not only increasing the number of clients with financial plans, but also charging for their planning services, marking a significant shift in the industry. Advisors who do not charge a fee for planning dropped from 28% in 2020 to 10% in 2023. Clients now expect to pay for the personalized guidance they receive, making it essential for advisors to adopt fee structures that reflect the growing value of these services.

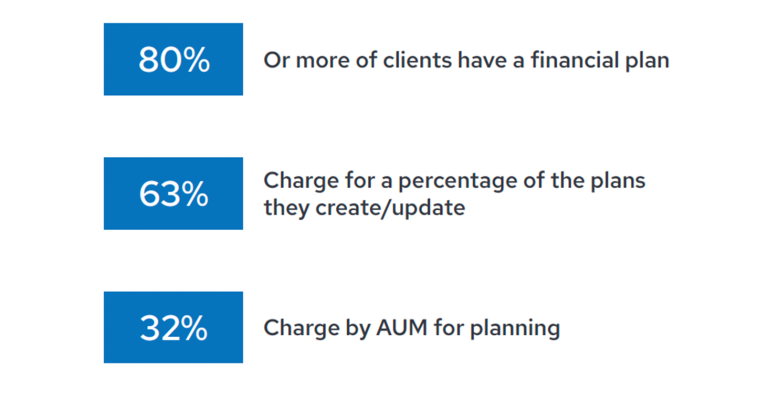

Among the advisors surveyed, 63% charge for a percentage of the plans they create or update, while 32% charge based on assets under management (AUM). This growing monetization of planning services highlights the need for financial advisors to carefully consider their fee models to remain competitive and profitable.

Of the advisors surveyed…

Both comprehensive and modular financial planning is on the rise

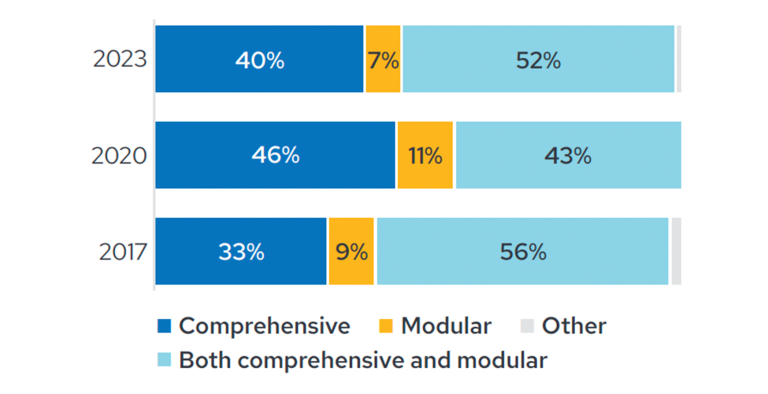

In 2023, 52% of advisors reported offering both comprehensive and modular planning services, a 9% increase since 2020. The rise in advisors delivering both planning services may reflect a response to various factors, such as clients' increasing demand for personalized financial strategies that address a wide range of needs, from basic budgeting to complex estate planning.

Level of planning

Comprehensive planning, which includes ongoing client engagement and check-ins, often requires higher fees but delivers more value. Modular planning, on the other hand, focuses on specific financial goals or life stages and may appeal to clients with less complex needs. Advisors must be flexible in their approach to match their fee structures with the specific services they provide.

Choosing the right fee model drives business growth

Selecting the right fee model is crucial for aligning your services with your business objectives, including:

- Client segmentation: Identifying ideal clients and their financial needs allows advisors to tailor their pricing. Are they younger clients with growing incomes but fewer assets, or are they retirees with substantial savings who require more complex planning? Segmentation helps advisors tailor their services and pricing accordingly.

- Scope of services: Charging higher fees for more complex services, such as estate planning or tax planning, delivers greater value to clients and will impact pricing, therefore justifying the cost.

- Growth strategy: Advisors should decide whether their goal is to prospect for new clients or focus on deepening relationships with their existing client base. This strategic decision can influence how fees are structured, particularly whether advisors choose to charge for new plans or only for plan updates.

- Payment flexibility: As client demographics and preferences shift, flexibility in fee structures becomes increasingly important. For example, younger clients with growing incomes may prefer to pay for financial plans over time rather than in a lump sum, while older clients may have different payment preferences. Understanding these nuances can help advisors build more sustainable and attractive pricing models that align with their business objectives and goals.

A strong value proposition justifies your fees

Clients are willing to pay for financial planning when they clearly see its value . Advisors who help them achieve their financial goals through well-crafted strategies, offer ongoing support, invest time in understanding client needs, educating them about financial options, and delivering tailored solutions will find it easier to justify their fees.

Fees will continue to evolve

Generally, we believe the survey findings suggest that the financial planning industry is moving toward fee-based models as clients increasingly recognize the value of personalized, ongoing financial advice. Advisors should consider offering both comprehensive and modular planning to meet the diverse needs of their clients.

As financial planning technology continues to advance, advisors are better equipped to deliver more personalized and efficient solutions for their clients at scale. By integrating these tools into their practice, advisors can not only enhance the value of their services but also create more flexible, scalable fee models that align with their business goals and growing client needs.

Download the full whitepaper: 2024 State of Financial Planning and Fees: Technology’s Impacts