The 2024 elections are over, although a few close congressional races remain uncalled. The vast majority of the results are in, however, and investors may now be wondering how the election will impact the U.S. economy and their portfolios. While we don’t have a crystal ball, we want to share a few thoughts about what may happen in the coming months and years.

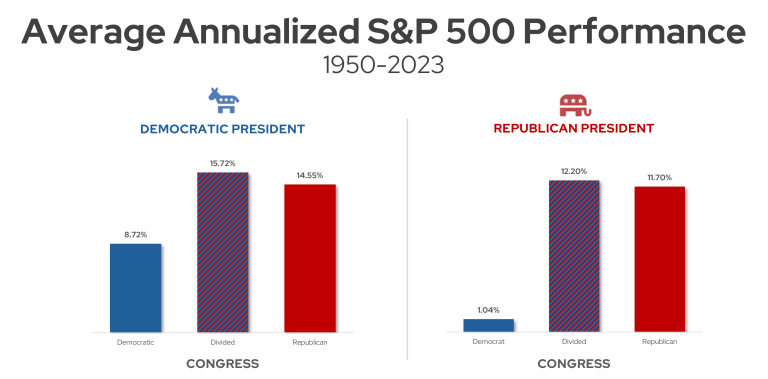

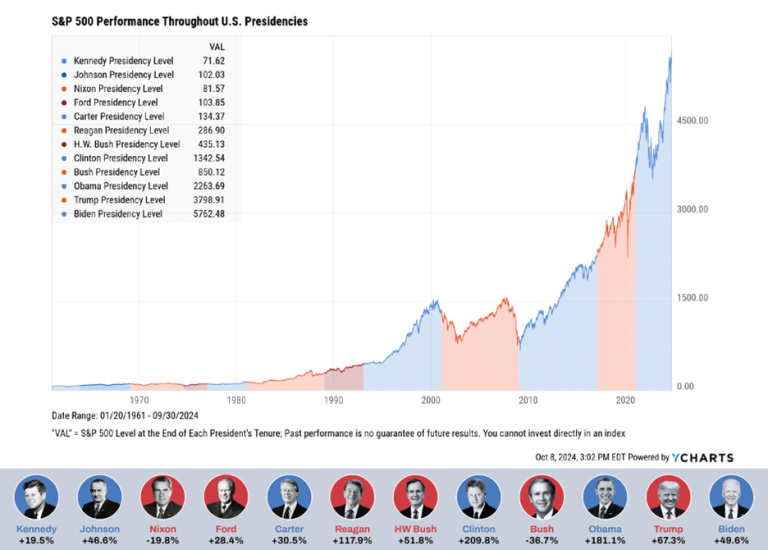

First of all, though, we want to emphasize that the U.S. stock market has historically risen under presidents from both political parties. While candidates often claim that electing their opponents will lead to economic ruin, the data show that stocks seem to largely ignore politics over the long-term. The markets are neither red nor blue! The visual below illustrates this point.

The election and the economy

Let’s first assume that the new Trump Administration successfully achieves three goals:

- Raising tariffs and reducing imports

- Renewing all of the 2017 tax cuts

- Restraining immigration

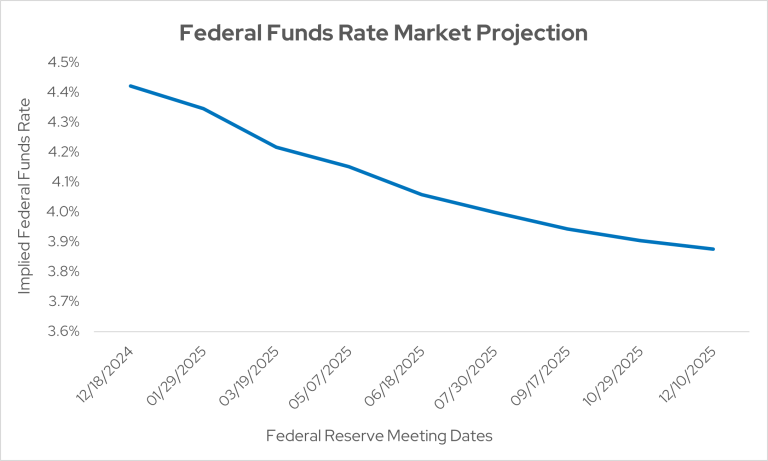

How might these efforts affect the economy? It’s noteworthy that all of these policies are likely to raise interest rates and prices. Why? Tariffs and import restrictions tend to elevate the prices of goods either through direct fees or by pushing manufacturing to higher-cost domestic sources. Tax cuts can fuel economic growth, too, which often elevates rates over the long-term. If the cuts add to the federal government budget deficit, that could push Treasury bond rates up, as well. As for restraining immigration, this push may trim the labor supply. This dynamic would enable U.S. workers to demand higher wages, but it can simultaneously support inflation. The Federal Reserve is likely to counter these inflationary impulses by keeping interest rates elevated. We’re already seeing rates traders dial back expectations for rate cuts next year, and that trend may continue. This current monetary policy loosening cycle may get nipped in the bud within months. As the chart below shows, the market currently anticipates that this cutting cycle will be largely finished by next summer.

Now, let’s consider how the new administration may affect economic growth and the labor market. The abovementioned tariffs and import reductions will likely have limited overall employment impacts. However, certain industries may either suffer significant headwinds or job growth. Most likely, we can imagine China as the potential loser while Mexico and India gain jobs. Trump's ire seems to be initially aimed at China, and he may find bipartisan support in some efforts aimed at punishing China.

Tax cuts are economic stimulants, ceteris paribus, Latin meaning "all other things held equal." We expect the Tax Cuts and Jobs Act of 2017 to be renewed next year. Will the Administration try to deepen the tax cuts further? Possibly, but Republican deficit hawks in Congress may push back unless government spending is also trimmed. No matter the details, tax cut renewals should be favorable for employment and economic growth…at least until the bill comes due. At some point, U.S. fiscal profligacy will likely face headwinds from the bond market.

As for immigration, it is probably going to drop under Trump 2.0. No matter where you are on the political spectrum, we think there are two crucial immigration facts to accept: 1. Immigration, whether legal or not, raises economic growth. 2. Undocumented migrants' lower wages in low-skilled jobs while simultaneously filling positions that most Americans do not want. For these reasons, reducing immigration will likely lower economic growth while supporting jobs/wages at the bottom of the economic ladder.

The presidential election and portfolios

What does all this mean for stocks and bonds? It is challenging to pick winners and losers based on forecast federal policies, but the market’s focus has shifted from who will win to how the results may impact company and sector performance. It’s equally critical to assess whether the market has already correctly priced the effects of likely policy changes. To outperform the market, you must be correct, and you have to be right before the market reaches the same conclusions.

Still, one thing is clear: Trump intends to run the U.S. economy hot, meaning he'll accept higher interest rates in exchange for higher growth. (He may also unintentionally get higher inflation—the very problem that frustrated his predecessor.) In this environment, stocks may outperform bonds unless the Federal Reserve is forced to engineer a recession to tame inflation. The new administration will start with inflation a bit high, of course. Bond coupons should be pleasing in this potential "hot" economic environment, although price returns may be constrained. Companies that aren't heavily dependent on imports (often small caps) may perform well, but firms heavily involved in foreign trade face risks. If interest rates rise significantly, small caps would probably suffer.

Economic growth is possible

In summary, the U.S. economy can continue to grow under Trump unless inflation reignites. We are more concerned about inflation now than in 2016 because the new administration is entering office with already “warm” inflation. This inflation/economic growth dynamic will be essential to watch. Inflation can torpedo an administration very quickly and that is the most significant macroeconomic risk on the horizon. If inflation stays away, the current economic expansion has room to run. Markets also have opportunities for further growth. However, high U.S. equity market valuations and the potential for renewed inflation are key risks on the horizon.

We want to end where we began by noting that the U.S. stock market has historically been politically agnostic. We continue to emphasize diversified portfolios with strategic allocations, too. The good news for investors is that long-term investing has been historically successful across the terms of almost all presidencies.

Visit https://newsroom.envestnet.com/ to access our research, perspectives from industry experts, and the latest news from Envestnet.