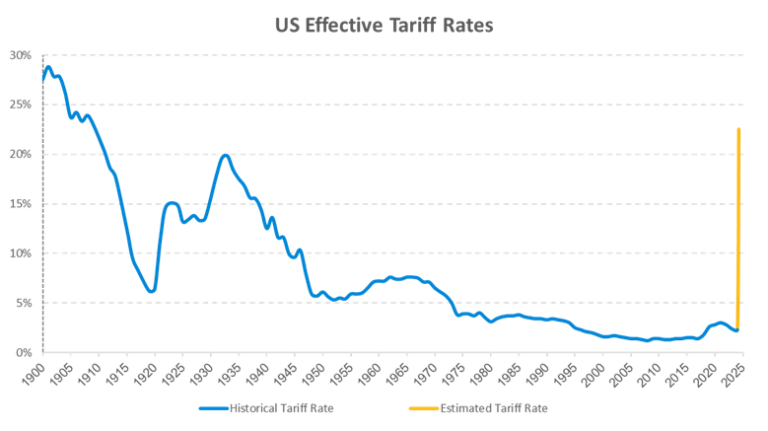

On Wednesday, April 2nd, President Donald Trump announced his much-anticipated tariff plans, including a 10% universal tariff on all countries and additional reciprocal tariffs on countries where the U.S. has the largest trade deficits. These global tariffs were much higher than most economists expected, and they are also different from the 20% universal tariff that Trump mentioned on the campaign trail. Adding the tariffs together, we see a 145% tariff on China, 20% on the European Union (EU), 24% on Japan, 26% on India, and 10% on the United Kingdom (UK), as of April 9th and not considering temporary suspensions. (Reciprocal tariffs on countries other than China have been temporarily suspended as of April 9th.) The announced duties yield the highest overall U.S. tariff rate in over a century. 1910 had an effective tariff rate approximately equivalent to what the U.S. has on April 11th. Because the technical details of this tariff plan have just been released and are fluid, overall estimates of the cumulative tariff rate differ. We believe the total national tariff rate will ultimately be between 20% and 25% after the suspensions are factored into our analysis.

Tariff fundamentals

Tariffs, occasionally referred to as duties, are essentially taxes paid to import goods into the U.S. (or another country). Tariffs are paid by the entity bringing in the goods for sale. Tariffs generally do not apply to services used in this country, but provided by people working in another nation. To avoid tariffs, a foreign company would need to produce its goods in the U.S. If a foreign automaker builds a car in the U.S. and sells it in the U.S., there is no tariff. Tariffs would, however, normally apply to U.S. companies building goods overseas and bringing them into the U.S.

Tariffs are typically assessed as a percentage of the value of the imported good. If you buy a $300 Italian suit jacket subject to a 20% tariff, it will cost $360 to buy the jacket and get it into the country (1.2 x $300 = $360). The tariff adds $60 to the price of the clothing in this example.

The U.S. has already instituted a 20% tariff on Chinese goods, along with 25% tariffs applied to many goods from Mexico and Canada. Importantly, tariffs can be added or removed largely at will by the president. They do not need to be voted on by Congress. President Trump can thus raise tariffs at breakfast and nix them at lunchtime (although it would take a few days for changes to take effect).

Tariff revenue flows directly into the government coffers and thus represents a straightforward way to reduce the budget deficit. Strategas estimates the U.S. tariffs will generate approximately $600B in annual revenue. Historically, countries generated substantial portions of their revenues from tariffs, although that source of income declined throughout the 20th century. After WWI and especially WWII, freer trade started to become a priority and trade barriers fell globally. U.S. tariffs had steadily dropped since the 1930s…until now.

Other countries almost always retaliate when hit with tariffs and consumers may adjust their purchasing habits when faced with higher prices. Retaliatory measures and the second-order effects of tariffs mean that their economic impacts are not easy to assess.

How tariffs may impact the economy

Tariffs will cause the price level to quickly jump, but tariffs should not cause a further rise in prices beyond 2025 unless they ratchet even higher. The inflationary impulse from tariffs has historically been sharp but temporary, because tariffs do not create prolonged price pressures. Long-term inflation is caused by steady upward gains in prices, although these tariffs will boost the Consumer Price Index over the next twelve months. Still, the Federal Reserve has historically hesitated to cut interest rates right after tariffs climb.

Tariffs would normally be expected to force U.S. interest rates and the USD higher, but the sheer magnitude of these tariffs has driven U.S. interest rates and the dollar lower. Why? Recession fears have gripped the markets. The 10-Year Treasury Yield dropped 13 basis points on April 3rd and nearly closed below 4%. The ICE USD Index fell nearly 2% from the tariff announcement through April 3rd. Remember that currency markets act to counterbalance all other economic forces, and that is especially true for tariffs. Economics are like physics: For everything, there is an equal and opposite reaction. U.S. economic growth will be impacted by these tariffs, too. Overall, the tariffs are likely to reduce or even eliminate Gross Domestic Product (GDP) growth this year. This type of slowdown is certainly unwelcome and it will impact investment markets.

Investment implications

The S&P 500 fell 4.84% the day after the tariff announcement, and the NASDAQ Composite plummeted nearly 6%. It was the worst day for U.S. stocks since 2020. The MSCI EAFE index of developed market equities dipped just 0.40% on April 3rd, though. Meanwhile, the Bloomberg U.S. Aggregate bond index rose 0.58%. These statistics illustrate that the U.S. stock market losses we have seen did not bleed over into all other key asset classes. This lack of correlation across global markets is a positive for investors with diversified portfolios. We continue to believe that concentrated allocations to any narrow range of investments increases risk. Global diversification fell out of favor with some investors in 2023 and 2024 as U.S. mega-cap technology stocks raced higher. Other investors ignored bonds as volatility remained low. Now that international stocks are largely outperforming their U.S. counterparts in 2025 and volatility has returned to markets, diversification is receiving renewed appreciation. The reason to remain diversified is that almost nobody can consistently predict when a hot asset class is about to go cold. Market timing is incredibly difficult. We continue to believe that bonds and international equities, among many other asset classes, contain attractive investment opportunities. Is it too late to diversify more concentrated portfolios? No. We think it is never too late to diversify. Psychological quirks can make investors hesitate to sell positions after recent losses, but we believe that diversification still makes sense despite the post-tariff announcement drop in U.S. stocks.

A historic event

The April 2nd tariff declaration was a watershed political, economic, and financial market event. The coming tariffs are unprecedented for a modern, large 21st century economy, and the reverberations of this new policy will be felt for years to come. Market volatility is likely to remain elevated as investors digest the tariffs and retaliatory measures revealed by other countries. That said, we do not believe that this is the time to put all your money under the mattress. Instead, we encourage portfolio diversification and prudent risk management. We understand that your clients are likely nervous. We are here to support you and your clients through market tumult.

For more information on Envestnet | PMC, please visit www.investpmc.com