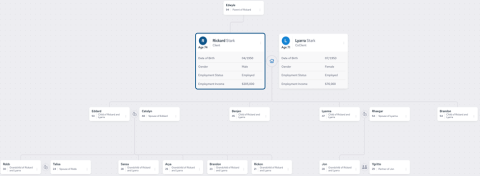

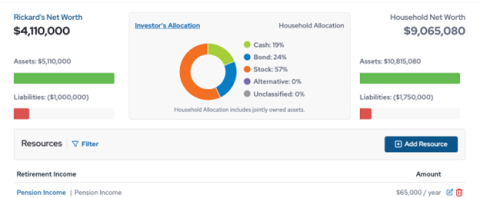

Family tree

Visualize your profile and family together in a single view. Family Tree allows you to add, edit, and analyze resources and net worth for both clients and participants. You can create up to four generations of a family tree with parents of the client down to clients’ grandchildren. Clicking on household clients allows you to see new detail around individual net worth and investment allocation. You can even add assets for family member participants!

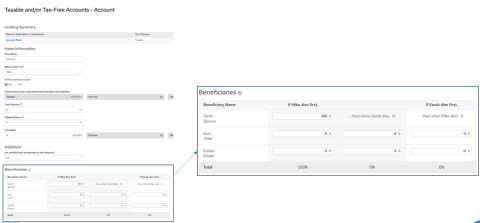

Account beneficiaries

Beneficiaries are now available in all account types including Taxable, Health Savings Accounts, and Coverdell Savings Accounts. This will impact the Estate calculation of the plan by showing assets not passing through the marital deduction at first death. Assets will still avoid probate. This will also impact the assets remaining for planning purposes for the surviving spouse, and can be observed in the Combined Details.

Please note, beneficiaries for these account types will not be used in Wealth Studios plans at this time, but will be in a future release.

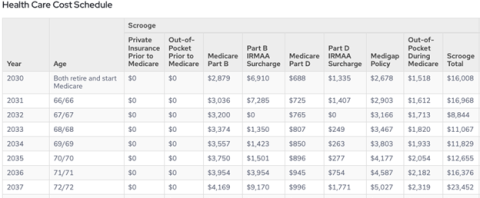

Enhancements to Health Care Expense Goal

The goal will now dynamically calculate Income-Related Monthly Adjustment Amount (IRMAA) during the retirement years. This calculation will apply to both Medicare B and D (if applicable). The IRMAA will be visible in the Health Care Expenses Schedule, Cash Flow Chart, and specified in the Annual Details window in Combined Details.

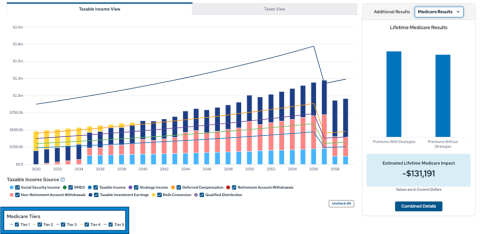

Enhancements to Tax Planning Module

The Tax Planning Module will be enhanced with a new output to highlight the savings related to how the modeled strategies impact the clients’ Medicare Premiums during their retirement. Please note, this feature is only available to MoneyGuideElite users.

MyBlocks updates

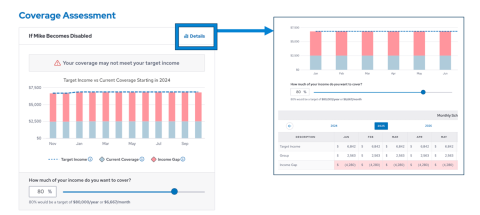

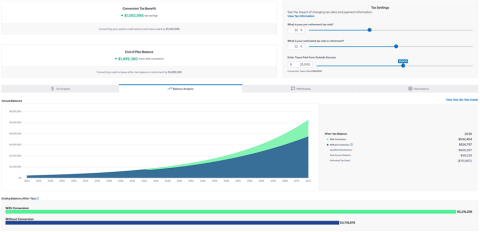

With this release we are introducing two new blocks:

Disability Income Insurance Assessment: Determine if an income gap exists based on a percentage of your current income compared to existing coverage and other expected income if a debilitating event were to occur.

Roth Conversion Calculator: Illustrate the potential impact of converting Employer-Sponsored Retirement Plans and traditional IRAs into a Roth IRA asset.

To see these updates in action, request a demo or give us a call at 1-800-841-5312.