Historically, financial advisory fees all followed one of a few basic structures. However, financial advisors have used several new compensation structures to remain competitive in recent years, and these can vary significantly. Below we’ll outline the similarities and differences to help you decide which financial advisory fee model or models may work for your practice.

Why are different advisory fee models structures needed?

Simply put, advisory fees are not one-size-fits-all. A fee structure that suits one financial advisor might not be the best choice for another. Some financial advisors make their living from fees alone, while others supplement advising fees with commissions, or even rely on commissions alone.

Client preferences vary, too. Some clients opt to stick to the traditional hourly advisor fee, while others prefer a more modern approach, such as the flat percentage rate or a hybrid model.

Some clients expect their advisors to be fiduciaries who are legally responsible to put the client’s interests first. Others are comfortable paying commissions on trades and recommended services. Yet other clients favor short-term, commission-based relationships with the financial professionals who look after their assets.

Investment advisory fees comparison

Here are some of the most common advisory fee models used by financial advisors today:

Hourly rate fee structures

The traditional hourly rate is still extremely popular among professional financial advisors. Hourly rates can be either flat (which sometimes represents a blend of different staff) or variable.

- Flat hourly rates can simplify customer billing, especially when it’s a blended flat rate. Instead of charging more for work completed by senior members of a financial services team, the financial advisor charges the client a flat (and blended) hourly fee. This fee is calculated by blending the hourly rates of the senior and junior employees working on the account.

- Billing of variable rates is more complicated, as clients are charged different rates according to which member of the financial planning team provides the services. If a junior assistant performs a task, for example, it usually costs the client less than had a senior partner been involved. A number of clients prefer this model instead of flat blended rates that make them wonder if they’re overpaying for minor services.

Regardless of the hourly rate structure, hourly billing may sometimes be perceived as conflicting with the client’s best interests. When clients pay for financial planning services by the hour, efficiency may be compromised, and the longer a task drags on, the more it costs. Clients may wonder whether they’re being billed for hours that aren’t solely focused on their account. They may also question whether all the work being done to manage their accounts is necessary.

In addition, hourly fees, where every phone call or meeting is billable, can result in clients being conscious of the ticking clock and less prone to contact their advisors, even when talking to an advisor would be in their best interest.

Flat percentage rate / Assets Under Management (AUM) fees

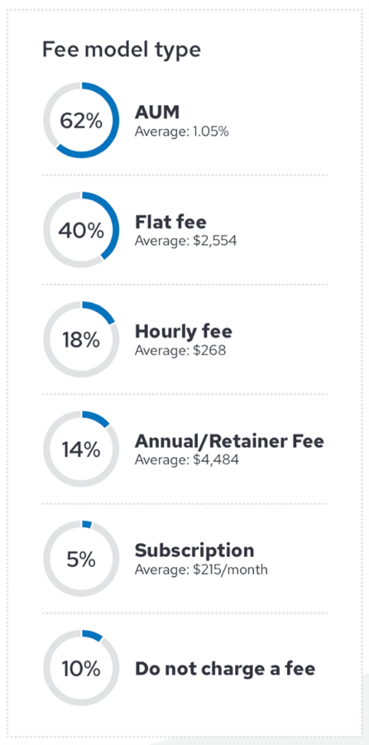

The flat percentage rate / AUM compensation model has grown in popularity over the years. In a survey of 600 advisors by Envestnet | MoneyGuide, 62% of advisor indicated that they used an AUM model.

This fee structure typically encompasses brokerage accounts and IRAs, but excludes employer-sponsored plans like 401(k)s, which generally remain inaccessible until the client leaves their job.

Charging clients flat percentage rate fees for assets under management has the advantage of being very transparent and easy to understand. For example, if the advisor manages $1,000 of the client’s funds, and the flat percentage rate is 1%, the fee would be $1,000 x 0.01, which equals $10 in fees payable to the advisor’s firm.

These accounts also make financial planning easier, as clients, advisors, and investment managers all know exactly what the fees will be upfront.

The more money the advisor manages, the higher the advisor’s compensation. A downside is that this compensation structure may make smaller investors less attractive to some financial advisors. Some advisors opt for account minimums to avoid working on accounts that are too small to generate sufficient income for the required workload.

On the other hand, holders of accounts with higher assets might not want to pay the same percentage rate on all of their money, so a flat percentage rate account might not appeal to them. This may disincentivize the client from adding more assets with their advisory firm.

Another drawback is the possible perception that financial advisors may pay closer attention to the accounts with larger assets than the smaller ones. The best way to combat this is through your client messaging and marketing efforts, so that your clients understand the philosophy and culture of your firm and how it aims to provide white-glove service to every client.

Percentage-tiered fees

Percentage-tiered fees (or multi-rate fee schedules) can help to alleviate client concerns about flat percentage rates. As the client's assets under management increase, the fee percentage typically decreases. This declining rate encourages clients to invest more, as they pay a lower percentage fee on higher asset amounts.

For example, if a client has an investment portfolio valued at $3 million, the advisor or investment manager may charge a fee of 1% on AUM below $1,000,000, equaling $10,000. The remaining $2 million may then be charged at a lower rate, commonly %0.75, or $15,000. This would make the client’s annual total in fees $25,000 rather than the $30,000 that a flat percentage rate would have yielded.

Like the flat percentage rate, some worry that tiered percentage rates may cause advisors to encourage clients to maintain high investment balances rather than use funds from their investment portfolio to enjoy retirement or clear debts.

Retainer fees

Charging an account management fee at an annual rate or as a retainer allows financial advisors to guard against fluctuations in the financial markets.

Annual retainer fees cover a wide range of financial management tasks, including investing in stocks and bonds per the client’s long-term financial goals and risk tolerance. For clients who favor the traditional asset allocation investment model, annual rates or retainer fees allow the advisor more flexibility than a percentage fee structure.

Clients with an annual rate or retainer agreement are usually charged monthly or quarterly. As a result, the financial advisor knows what money is coming in and when, which can be beneficial for advisors. The expense predictability of the annual rate or retainer is also attractive to many clients. In addition to knowing how much to budget for financial advisor fees, the fee remains the same, even if their investment portfolio overperforms.

As portfolio performance doesn’t affect the financial advisor’s fees, some clients worry that advisors may be less motivated to actively manage their investments, and may not consistently prioritize decisions based on their best interests.

Subscription

One new model that advisors are adopting is the subscription fee model. Under this model, clients pay for a defined set of meetings, services, and other touchpoints on an ongoing basis.

One benefit of the subscription fee structure is that it’s attractive to younger demographics and can enable advisors to build lasting relationships as clients progress in their higher earning years. The monthly revenue stream is highly predictable, since it’s not tied to wallet share or market performance.

One downside to this model is that clients may expect advisors to deliver a tangible service every month, and may also reevaluate their relationship every month. In order to serve clients better, some advisors may start with a subscription model until clients reach a certain wealth level or experience a significant life event, and then transition to a fixed fee or AUM fee.

Fixed fee / Project-based compensation

90% of advisors surveyed by Envestnet | MoneyGuide charge financial planning fees, and 40% of these advisors utilize a fixed fee. A fixed fee enables advisors to charge for a specific service or the work completed on a limited project. Examples include creating a financial plan for long-term care, estate planning, or planning to guard against tax loss.

The benefit of the fixed-fee/project-based compensation structure is that the client knows what the service will cost, and the advisor knows how much they’ll earn performing it.

However, because the fee remains the same no matter how much time an advisor spends on the project, conflicts of interest can be a concern. Clients may worry that unscrupulous advisors could take advantage of the guaranteed income and limit the hours and work performed on their account, potentially resulting in poor advice and subpar results.

Hybrid model

For clients, the best form of financial advice delivery often depends on circumstances, which can change from year to year. This is why many financial advisory firms offer clients a mixture of the fee structures detailed above.

For example, an investor who normally pays for personal capital management on an hourly basis might negotiate a fixed flat fee for a specific project such as retirement planning or to finance long-term care. This way, the client knows up front what the particular service will cost.

Another example of the hybrid payment model upfront is when a fixed-fee project such as estate planning is complete, but situations change, and the plan must be updated. In this case, additional work can be charged by the hour.

Offering a variety of fee models also allows advisors to cater to different client segments and wealth levels.

How to decide which model is right for your practice

With so many options to choose from and hybrid compensation structures to consider, finding the right model for your business comes down to personal preference, what you think your target clients may prefer, and what will make your business stand out from the rest.

For example, financial advisors who act as fiduciaries must put their clients’ best interests first without making any third-party commission on investments they advise or services they recommend. This means they should operate under one of the above fee-only compensation structures.

An alternative to fee-only advising is fee-based advising. Here the financial advisor retains the right to make a small percentage of their money from commissions on, for example, exchange-traded funds (ETFs) they advise clients to purchase or insurance policies they recommend clients buy.

Advisors whose entire earnings come in the form of commissions on investment accounts they open or products they sell are known as “commission-based”, and are typically referred to more as brokers.

Commission vs. fee-based

Both commission and fee-based compensation allows advisors to earn money from the trades they recommend and the products and services they advise clients to purchase. The big difference between commission-based and fee-based financial advising is that the former makes money based on the number of individual services sold (e.g., usually trades), regardless of their performance. The only requirement the commission-based broker or advisor has to meet is that the products they sell are considered “suitable” to the client.

While fee-based advisors can earn some money under this model if they prefer, they are required by the SEC to hold the client’s best interest in the management of clients’ investment assets. Although this isn’t the same legal standard the SEC holds fee-only advisors to, it may generate greater advisor/client trust than with commission-based services and lead to a longer, less one-sided relationship.

A strong value proposition justifies your fees

Clients generally are willing to pay for financial planning when they clearly see its value. Advisors who help their clients achieve their financial goals through well-crafted strategies, offer ongoing support, invest time in understanding client needs, educate them about financial options, and deliver tailored solutions will find it easier to justify their fees. See tips for choosing the right fee model.

Financial advisor fee comparison FAQs

What is the average fee for a financial advisor?

The average fee depends on the fee structure the client opts for and, often, the size of the financial portfolio.

According to the Envestnet | MoneyGuide 2024 State of Financial Planning & Fees Study:

- The average fixed percentage fee for a financial advisor is 1.05%

- The average flat fee is $2,554

- The average hourly rate is $268

- The average annual/retainer fee is $4,484

- The average subscription fee is $215/month

How are financial advisory fees calculated?

Hourly advisor fees are calculated according to the financial advisor’s log of the work done on the account.

Fees for financial advisors under AUM agreements are a percentage of the assets the advisor manages at a given time during the billing period. These are usually collected quarterly and are based on the AUM at the end of a quarter.

Retainer and project-based fees are proposed by the financial advisor and agreed on by the client at the start of their business relationship.

Are all fee-only advisors fiduciaries?

To be licensed by the SEC (the U.S. Securities and Exchange Commission), all fee-only financial advisors must act as fiduciaries. That is, they are required by law to act in a client’s best interests.

Certified financial planners (CFPs) are also fiduciaries who have earned special licenses that attest to their expertise in financial planning services for investments, education, retirement, and more.

What is the difference between fee-only and fee-based advisors?

A fee-only investment advisor earns money only from the fees their clients pay them. They do not supplement this with commissions or kickbacks. Therefore, the higher the AUM the advisor manages for their clients, the higher the fees.

A fee-based investment advisor, on the other hand, may also earn commissions for selling products such as mutual funds or insurance products, which may potentially put them in conflict with clients’ best interests.

Simplifying advisory fee billing with BillFin

"The integration of BillFin into our practice has saved us countless hours in calculating our client management fees. Furthermore, the ability to exclude assets from billing and provide manageable discount schedules has provided the flexibility we need to compete with many of the larger firms."

Seth Stewart

Managing Partner, Brookstone Financial

No matter how complex your advisory fee billing structure may be, or which advisory fee model you choose, Envestnet offers both AUM and subscription-fee billing solutions via Envestnet BillFin and Envestnet Payments.

BillFin, our cloud-based advisory billing software, can help simplify your fee billing processes. With BillFin, you can calculate flat, tiered, and banded AUM fees, set up competitive advisory agreements, and make your billing flexible, scalable, and transparent for your clients and business alike.

Envestnet Payments equips advisors with the ability to offer flexible fee options to their clients, including subscription, hourly, and retainer. Easily invoice and collect professional services fees securely via credit card or ACH transactions.

See how Envestnet can help you with your billing technology by requesting a demo or starting a free trial of BillFin or Payments at https://www.envestnet.com/schedule-demo