Envestnet’s Wealth Management Platform ensures that financial professionals remain engaged throughout the investor life cycle by offering a complete technology experience, insightful analytics, and a variety of solutions, all supported by top-notch service and assistance. Continue reading to see how our February 14, 2025 technology release aligns with our mission.

Simplify your tax harvesting with our new multi-harvest trade simulations

We’ve simplified the review of tax harvesting scenarios for a managed account or multi-account management group by allowing advisors to simulate multiple harvest trade operations at the same time. Previously, advisors could only simulate one harvest trade operation at a time, which lacked efficiency when managing a larger number of accounts and cost advisors more of their time in the platform.

If you’re involved in your clients’ tax planning, you can use this feature in your review process. With this enhancement, you can now spend more time analyzing and acting on your clients’ tax management goals, and less time running scenarios.

New Investment Strategy Proposal (ISP Lite) enhancements bring more pages, functionality, and French language options

The ISP Lite document has been a reliable tool for quickly and clearly communicating your investment proposal plans to clients. We understood that there were some areas it didn't address. This release aims to improve its coverage and usefulness by incorporating new pages and functionality that we’re excited to share with our valued platform clients.

New ISP Lite pages:

- Donor Advised Funds

- Annuity layout pages

- Digital Portfolio Consultant (DPC) Questionnaire

- Impact pages: Impact Alignment, ESG Risk, Additional Details.

Eight new ISP Lite pages are now available in French.

Modify your Good Till Cancelled (GTC) trade orders despite negative cash issues

When advisors face complex negative-cash issues, they can now modify and replace equity conditional orders to provide a seamless solution, on any Envestnet trading platform that they’re using.

Previously, the ability to Modify Trades and Replace equity conditional orders was disabled if any account in the block trade showed a negative cash balance. Now, advisors can update block trade properties for equity GTC conditional orders despite negative cash issues in any account within the block. This allows advisors to make the changes in a timely manner and helps protect the integrity of their trade orders.

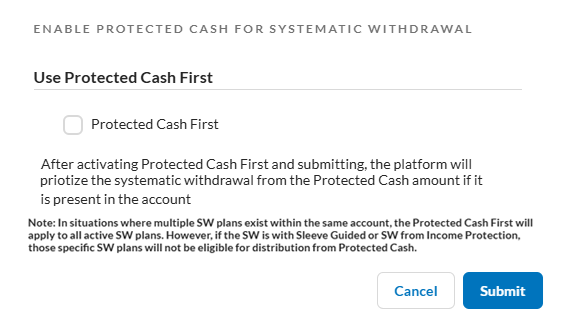

Added flexibility when funding systematic withdrawal plans

With this enhancement, we’re giving you even more flexibility when funding systematic withdrawal plans. The client's account page now allows advisors to set a preference for using protected cash first when paying out a systematic withdrawal plan.

Instead of raising funds during scheduled distributions, this feature allows you to raise funds at an optimal time, hold them in protected cash, and use them later to cover a plan or scheduled distribution.

Get the most out of each platform release

For our comprehensive release notes and additional information, reach out to your Envestnet Enterprise or Regional Consultant. We also invite you to learn more about these exciting enhancements at our designated resource center for our first release of 2025.

Learn more about our first release of the year at https://go.envestnet.com/R1-Release-Enhancements