Behavioral finance plays a critical role in understanding how psychological influences and biases impact financial decisions, particularly during election years. In these periods, investor behaviors such as confirmation bias, recency bias, and herd behavior become more pronounced, often leading to irrational investment choices. By preparing for potential market swings and emphasizing long-term investment strategies, advisors can help clients navigate the uncertainties of election cycles. Understanding the historical context of market performance during past elections can also provide valuable insights, allowing investors to make more grounded and informed decisions.

Let’s take a look at how all of these concepts work together and identify some actions advisors can take today to support their clients.

Behavioral finance and elections

Behavioral finance is the study of how psychological influences and biases affect the financial behaviors of investors and financial practitioners. In an election year, we specifically watch for:

Investor biases

Investor biases such as confirmation bias, recency bias, and herd behavior significantly influence investment decisions.1 Confirmation bias leads investors to seek out information that supports their existing beliefs while ignoring contradictory evidence, resulting in overconfidence and poor investment choices.2 Recency bias causes recent events to disproportionately influence investors' expectations of future events, which can lead to panic selling during downturns or excessive buying during rallies.3 Herd behavior, the tendency to follow the actions of a larger group, can exacerbate market trends and lead to bubbles or crashes.4

Emotional reactions

Emotional reactions, particularly fear and greed, dominate market behavior, especially during election cycles. Advisors need to help clients manage these emotions to avoid irrational investment decisions. Behavioral finance shows that market psychology, driven by collective emotions, can impact stock prices and investor decisions.5

Market volatility

Market volatility often increases during elections due to uncertainty. Advisors should prepare clients for potential market swings and emphasize the importance of sticking to long-term investment strategies.6 Diversification remains a key strategy to mitigate risks associated with market volatility.

Individual investors may be affected by one or all of these factors. Naming and addressing them makes the impulses easier to question and to counteract in the moment.

What U.S. election history tells us

While past performance does not predict future performance, it is true that historical data can help investors to feel more grounded in their financial decisions. Let’s look at a few historical data points to put election year market volatility into perspective.

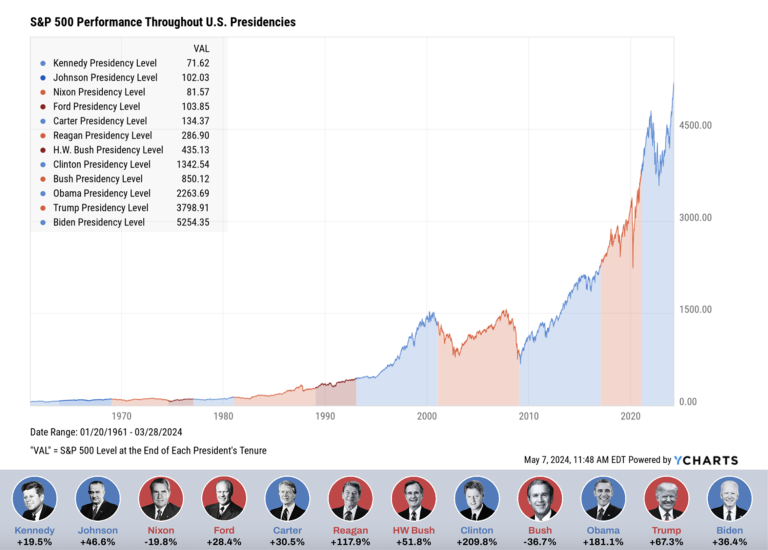

First, it is important to remember that equity market outcomes have been generally positive over the long term. From a political viewpoint, dating back to John F. Kennedy’s inauguration in 1961, the S&P 500 posted a negative return during only two presidencies: Richard Nixon and George W. Bush.

Second, it is valid to expect some market volatility around the electoral events. In the months leading up to U.S. presidential elections, markets might be more unpredictable, but historically, they tend to stabilize and sometimes rally after the election results are clear, particularly if the outcome reduces uncertainty or is perceived as market-friendly.7 That said, the specific impacts can vary widely depending on the election context and the candidates involved.

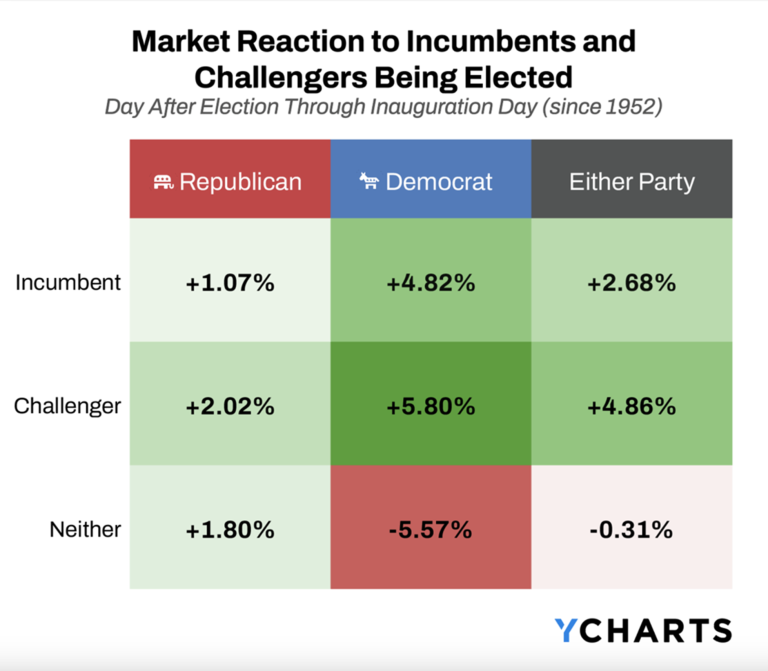

In most cases historically, the S&P 500 has posted positive returns between election day and inauguration day, regardless of who wins the presidency. Since 1952, Democratic presidents winning reelection have historically led to the most significant S&P 500 returns in this post-election period. Conversely, lower returns have tended to occur when the winning candidate was neither an incumbent nor a challenger, such as in election cycles that replace a termed-out president.

Do we know what will happen in Q4 2024? Of course not. But historical data gives us no reason to panic, suggesting that staying calm and maintaining a long-term focus will continue to be a wise choice.

Issues directly impacted by the election

Depending on the elected administration, there are several different factors to keep an eye on. This is not an exhaustive list, but rather an introduction to how the Republican and Democratic administrations could impact investors.

Tax issues

If Republicans sweep the November election, the 2017 Tax Cuts and Jobs Act—which reduced corporate and individual tax rates, and expires at the end of 2025—may be extended and potentially enhanced. Some strategists project that the Act’s extension could add about $1.6 trillion to federal deficits over the next decade.8 Deficits are a critical issue, since the cost of servicing Treasury debt has nearly doubled over the past two years. As federal debts and deficits expand, inflation-adjusted interest rates rise, which may put pressure on U.S. corporate profits and equity valuations. And extension would also benefit tax rates for the wealthiest Americans.

A democratic win would likely result in higher taxes for wealthier Americans and more tax cuts for lower income Americans.9 The Tax Cuts and Jobs Act of 2017 presented a significant opportunity for estate planning by more than doubling the lifetime estate tax exemption to $13.61 million for individuals and $27.22 million for married couples in 2024. However, this provision is scheduled to sunset on January 1, 2026, at which point the exemption will revert to approximately $7 million for individuals and $14 million for married couples, adjusted for inflation.10 For investors, this estate tax uncertainty necessitates proactive planning to maximize the tax-free transfer of wealth.

Trade and foreign policy

Generally speaking, both political parties have shown that they may continue to embrace President Trump’s protectionist and de-globalization policies, particularly as they concern China and Mexico. In February, he confirmed that, if elected, he would explore tariffs of “more than 60%” on Chinese imports.11 The implications of such a move could be wide ranging.

Our current Democratic administration hasn’t reversed many of President Trump’s policies over the past four years. The tariffs on Chinese products remained in place until this past April when they were expanded, tripling some tariffs on Chinese steel and aluminum. In May, the administration went further, increasing tariffs on electric vehicles, solar cells, semiconductors and advanced batteries. European steel and aluminum tariffs were scaled back, not eliminated. The Inflation Reduction Act created incentives for companies to keep their operations in the United States.12

Investors may want to consider balancing their exposure to companies impacted by these policies.

Regulatory environment

Traditionally, Democratic administrations tend to increase corporate regulations, whereas Republican administrations tend to decrease corporate regulations. This can have a direct effect on highly regulated industries like big tech, agriculture, and pharmaceutical corporations, and affect corporate mergers in coming years. Similar to global exposures, investors may want to consider balancing their exposure to highly regulated industries.

Immigration

Some researchers have noted that the surge of more than three million immigrants to the U.S. in 2022 and 2023 has had dual economic benefits (higher population growth and positive labor supply)—helping to drive higher GDP growth, stabilizing housing prices and lower wage costs, and contributing to the reduction in inflation. With that said, major border policy changes, as suggested in some Republican proposals, could slow the growth of the U.S. working-age population, potentially weighing on the economy and reigniting wage-based inflation.13

Social security and Medicare

While the Republican party tends to be considered more “anti-” social security and the Democrats tend to be considered “pro-” social security, some experts believe that this is one area that could remain largely untouched by either administration. Some Democratic candidates have sworn to keep the programs running, and current Republican candidates say they “won’t cancel them,” but also haven’t explained how they’ll keep them financially solvent.14

How advisors can support their clients

As an advisor, there are three actions you can take today to help your clients feel more secure leading up to the 2024 presidential election:

- Educate and inform: Regularly update clients on potential market impacts of the election, providing unbiased analysis and trusted sources of information. Explain how different election outcomes might affect various sectors and the overall market, helping clients understand the broader context.

- Reinforce long-term strategies: Remind clients of their long-term investment goals and the importance of sticking to their established strategies. Highlight historical data showing market resilience and recovery post-elections, emphasizing the benefits of maintaining a diversified portfolio.

- Increase communication: Add additional touchpoints with clients through newsletters, webinars, or personal meetings. Offer reassurances by addressing their concerns directly, providing clear and consistent messaging about market conditions, and being available to answer questions or provide guidance as needed.

Educating clients about behavioral biases and their impact on investment decisions can lead to more informed and rational choices. Clear communication about the potential effects of election results on specific sectors or the market as a whole can help clients stay focused on their long-term goals. It’s essential to share trusted sources of information and position yourself as a reliable source. Always keep communications firmly rooted in the big picture to ensure clients maintain a long-term perspective.

Visit https://newsroom.envestnet.com/ to access our research, perspectives from industry experts, and the latest news from Envestnet.