Improvements to the ISP Lite Document

As we continue to modernize and improve usability, navigation, and functionality of the ISP Lite document, we’ve added the following new pages and functionality:

- Strategy Modification support. Seamlessly create ISP Lite documents directly within the Strategy Modification workflow, enhancing efficiency and ease of use.

- ISP Lite in French. Generate an ISP Lite document in French.

- New ISP Lite pages. We’ve added more pages to the ISP Lite report as a part of our effort to continue to improve the ISP Lite document. The new pages include:

- RTQ Questionnaire Response

- Past Performance Analysis

- Investment Growth

- Annualized Returns

- Calendar Year Returns

- Monte Carlo Simulation

- Expanded Target Asset Allocation page

These enhancements will expand the offering so that firms can customize their communication with potential clients better. Firms can tell their proposal story better - in English or French, and with an expanded array of analyses to support it.

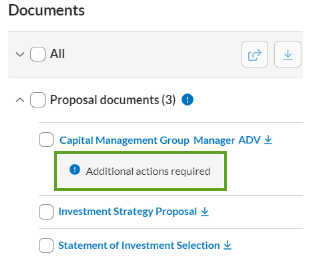

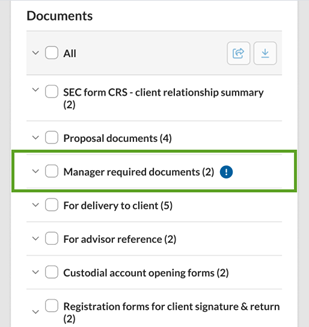

Manage documents and see when additional actions are required

Managing documents and resolving any issues with them in the Proposal tool has been a manual and time-intensive process. This release, you can more efficiently manage documents in the Proposal tool with the following enhancements:

- New alerts for required actions. Now, you'll immediately see when you need to take actions for documents in the Proposal tool. Selecting the alert provides you with more information about the required actions.

- New document family type. The new Manager Firm Document family type contains all manager firm questionnaires and new account instruction documents. Access these documents in Content Management, under Documents and Links.

- New document section. The new Manager required documents section contains all questionnaires and new account instruction documents associated with the external products or sleeves selected on the Account Strategy page.

These enhancements help you better manage required paperwork in the Proposal tool while reducing necessary interventions from the Operations team.

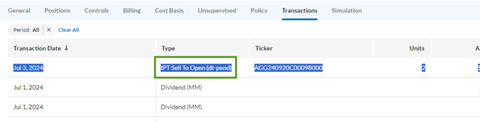

Create and map new transaction types for options trading

We’re mapping new options transaction types to make trade reporting more accurate, and so that in the future we can allow firms to offer options trading in APM accounts on the Envestnet platform.

Currently, some firms enter and execute options trades off-platform. When you trade options off-platform, we’re making it easier to identify the type of trade executed. With this release, on the Envestnet platform users will see new transaction types for options anywhere they see transactions on Envestnet today, like:

- Options transactions in an Account’s Transactions tab.

- Pending, Rejected, Unscheduled, Confirmed options trades in Trade Reconciliation.

For options trading only, users will see the following new transaction type names:

| Existing Transaction Type—option trade | New Transaction Type—option trade |

|---|---|

| Buy | Buy To Open |

| Sell | Sell To Close |

| Sell Short | Sell To Open |

| Cover Short | Buy To Close |

As we expand to support options trading in the future, properly licensed advisors can be configured with the ability to enter these types of options trades for APM accounts directly on the Envestnet platform.

Platform reports and views

With this release, on the Envestnet platform you’ll automatically see the new transaction type name for past and future options transactions.

Extracts and exporters

We know that if you export options trading data from Envestnet, downstream systems could depend on transaction type names. Users won’t see the new options transaction type name on extracts and exports until you opt into it.

Seeing these transaction types accurately named on the platform is useful—even when users trade options off-platform. Plus, users will be ready to leverage these same option transaction types when we offer options trading on the Envestnet platform.

Improvements to the Model Builder tool

Building models in the Proposal tool is a useful and important feature. We heard your feedback and with this release, we have included several improvements in model builder that will improve the user experience and help users move seamlessly with the tool:

More flexibility when creating a custom model. Users can now enter securities & products/models without having to enter target percentage and drift when creating a model. This gives you the ability to first add securities then add target percentage and drift. This gives users more flexibility when using model builder.

Clearer error messages in UMA and APM models. As part of the functionality change highlighted above, we have also made changes to the in-line error messages. If users try to save a model that doesn’t meet the model allocation or drift requirements, they will be presented with an error message. In these scenarios, model builder will highlight the cells with errors, and present a tooltip to explain the changes they need to make. Additionally, the save button will be disabled until the errors are addressed. This will improve accuracy and give users the information they need to adjust.

This update will streamline your work processes and allow users to enter proposed securities and products/models faster while building their model.

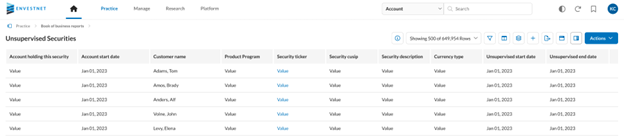

Introducing the Unsupervised Holdings book of business report

Sometimes, your clients may hold assets or securities that they don’t want managed. The Envestnet platform considers these holdings to be unsupervised and does not include with other managed holdings. In the past, it was hard to get a holistic view of all of your clients’ unsupervised holdings. In order to see them, users needed to generate that data by running an ad-hoc report. Now, you and your clients can use the Unsupervised Holdings book of business report to see all unsupervised holdings in one place.

Being able to quickly view all unsupervised holdings in one place boosts transparency and gives you and your clients a greater holistic understanding of their portfolio.

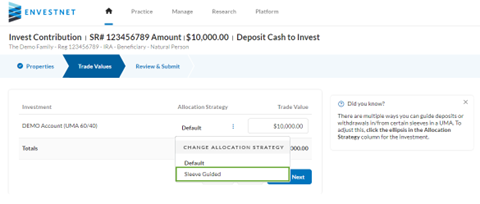

Guide cash flows to and from sleeves for accounts in shared models

Before this release, if users used the sleeve guided option in Raise Cash and Invest Cash service requests, they could allocate external cash flows to individual sleeves in a registration with a single UMAv2 account. These sleeve guided options were not available when the model was shared - meaning the model housed other accounts or proposals.

With this release, we’ve expanded our sleeve guided capability so that users can raise cash from or invest cash into specific sleeves or positions in a UMAv2 account even when it’s attached to a shared model.

This enhancement applies when users are configured to use it with the sleeve guided capability in the following service request types:

- Raise Cash

- Invest Cash

When an account is attached to a shared model and users start a sleeve guided Raise Cash or Invest Cash service request, the platform preserves and converts the account’s shared model as a Personalized Client Model (PCM) for the account.

This feature expands the ability to direct where assets go, allowing for more customized investing. Users will be able to control the allocation of deposits into sleeves for more accounts than ever before, using the proven and automated service request process.

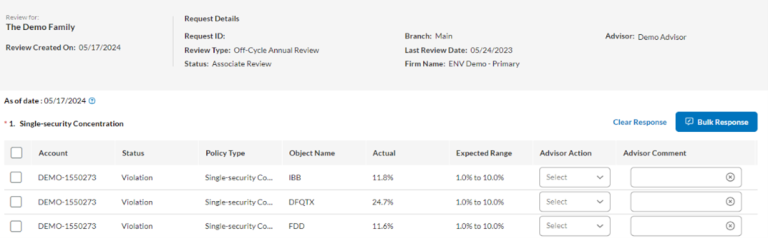

Access Client Reviews directly from the Envestnet platform

Client Reviews let you catch up with clients, review key account details, and strengthen client relationships. With this enhancement, we’ve directly integrated client reviews into the Envestnet platform. In the past, accessing client reviews opened a separate off-platform tab in your web browser. Now, selecting client reviews opens them directly in the active window.

Directly integrating client reviews unifies Envestnet’s platform offerings and provides a more stable and streamlined user experience. This enhancement helps you stay focused on your work and speeds up navigation on the platform.

Want to know more?

For our comprehensive release notes and additional information, reach out to your Envestnet Representative or Regional Consultant. We also invite you to learn more about these exciting enhancements at our designated resource center for our fourth release of 2024.

Stay up-to-date on all things Envestnet! We invite you to follow us on LinkedIn, Twitter and YouTube.