Concentrated equity holdings don’t mesh with the concept of portfolio diversification, and high-net-worth investors frequently need help dealing with these assets. Inheritances sometimes contain large numbers of shares of an individual stock, but these positions are more commonly accumulated by company executives who receive equity through workplace incentive plans. No matter how their clients come to own a significant amount of one stock, advisors need to have tools to address these portfolio “lumps.” Not surprisingly, risk management and tax efficiency are two key considerations in these scenarios.

While derivatives—such as options contracts—may conjure thoughts of exotic and dangerous trading strategies, they can also be used to hedge against losses. Options can be used to generate meaningful income, too. A concentrated equity position offers the potential foundation for one of three main options overlays to manage the holding. We’ll dig into these possible “option-tunities” in a moment, but let’s first examine why concentrated stock positions can create excessive portfolio hazards.

Concentrated holdings, concentrated risks?

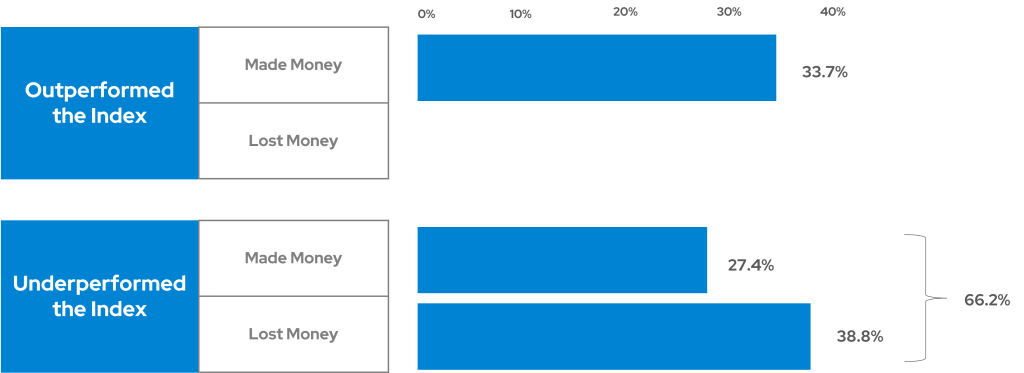

When we drill down into historical equity market returns, we see that most US stocks have lagged the Russell 3000 Index since 1987. Betting a client’s financial future on a single stock has thus been an attempt to beat the odds. Just how tall are those odds? Over 66% of Russell 3000 constituents underperformed the index from 1987 through June 2023, as seen in the illustration below.

Source: BlackRock. Breakdown of returns for individual stocks in the Russell 3000 Total Return Index during the dataset period. Each security return and excess return is measured over its lifetime. Past performance is not a guarantee of future results. Research produced by Aperio using data obtained from MSCI, January 1, 1987‒June 30, 2023. Index returns do not reflect deducting fees, expenses, and transaction costs. Index returns reflect the reinvestment of dividends, capital gains, and interest. Security returns are gross of all fees and transaction costs calculated by MSCI. Excess return is defined as security return net of benchmark return. Indexes are unmanaged groups of securities. You cannot invest directly in an index.

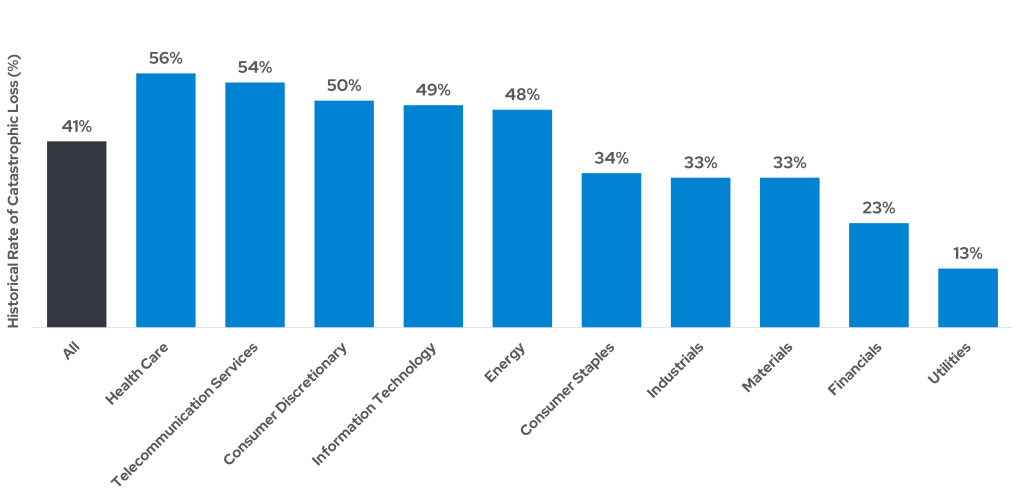

The US equity market has, in some ways, resembled a casino: A small number of stocks won big while the majority of issues fell behind the overall market. Hundreds of corporations have gone bankrupt every year since 20101, too, typically leaving their investors with little to nothing following reorganization or liquidation. Catastrophic losses—defined as a decline of 50% or worse without recovery—are actually quite common in the stock market, a fact that further argues for diversification and against concentration in portfolios.

Source: BlackRock. Breakdown of returns for individual sectors in the Russell 3000 Total Return Index during the dataset period. Past performance is not a guarantee of future results. Research produced by Aperio using data obtained from MSCI, January 1, 1987‒June 30, 2023. Data decomposition into ten sectors based on MSCI’s classification at the earliest date of available data for each security in the Russell 3000 Total Return Index. A catastrophic loss is defined as a decline in a security’s peak-to-end value of 50% or greater over the study period. Indexes are unmanaged groups of securities. You cannot invest directly in an index.

Options, explained

Now that we’ve assessed the potential threats associated with concentrated equity holdings, let’s see how options can impact the risks:

Covered call strategies have become increasingly popular over the past several years with the assets invested in derivative income strategies rising above $60B.2 The increase in interest rates and volatility following the 2020 COVID crash caused income generation in the options market to become more attractive, especially for clients with concentrated stock exposures that carry impediments to unwinding those positions. Covered call strategies offer investors an opportunity to generate income from concentrated positions that would otherwise be left unmanaged. Selling a call option allows income (known as premium in the options market) to be collected up front from the buyer of the call options. The buyer is paid a premium in return for accepting the risk that the price of the underlying security rises above the agreed upon strike price of the calls at the expiration of the option. If the security’s price is above the strike price of the calls, the option seller will experience losses.

Hypothetical illustration by Envestnet Quantitative Research Group.

To compare this to a real-world scenario, sellers of options can be thought of as an insurance company. Insurance providers charge a premium for insurance policies in exchange for the promise to pay the policy owner for damages in the event of a loss. For insurance companies to generate a profit, they must price policies so that the premiums generated exceed the outlays for claims. This analogy sums up an important concept when it comes to selling call options. The income generated from the options (price of the policy) must be weighed against the risk of the stock’s price being above the strike price at expiration, resulting in the shares being called away. This scenario results in losses on the options (higher claims than premium generated) and potential tax consequences from realizing gains in the concentrated position. Covered call strategies can be a very effective tool to generate additional income and offset a portion of the risk of a concentrated position, but it is important to understand the premiums generated relative to the risk profile of the call options being sold.

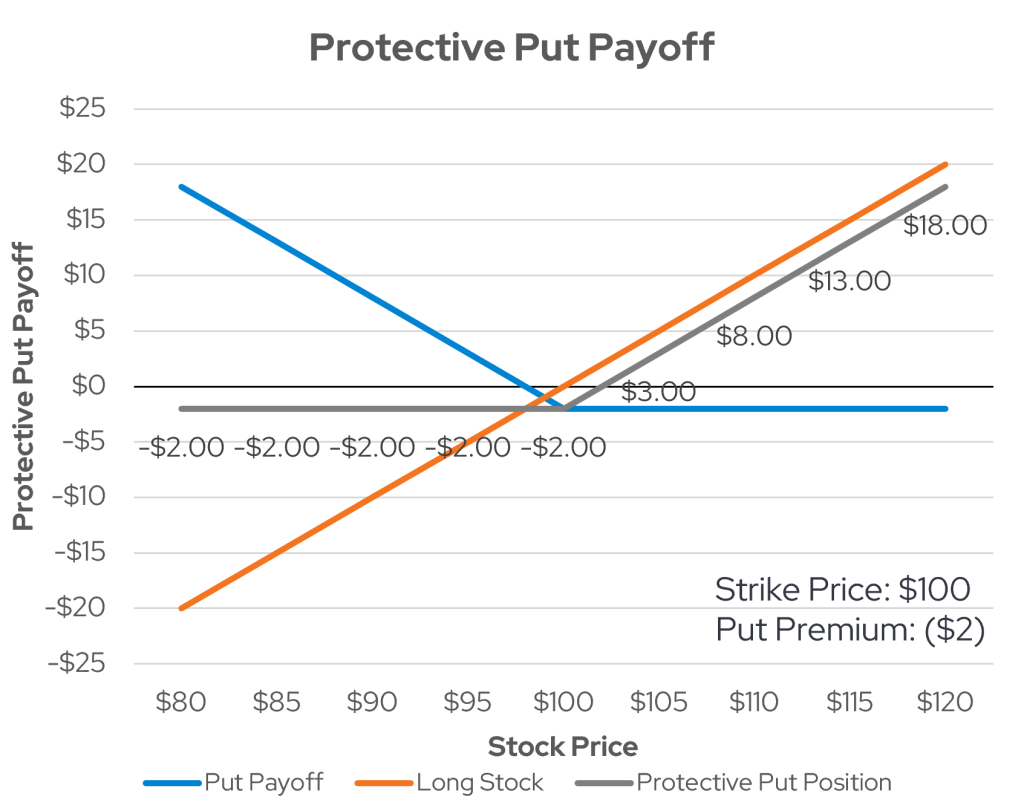

Covered call strategies provide investors with an opportunity to generate income over and above the return of a concentrated stock position, however, these strategies only provide wealth protection in the amount of the income generation. Many clients with concentrated stock positions seek the ability to directly hedge their wealth against a precipitous decline in the price of that stock. Protective put strategies can provide that type of protection by purchasing puts with a strike price that corresponds to a client’s desired level of downside protection. Buying a put gives the buyer the right to sell a stock at the agreed upon strike price at expiration regardless of the price of the stock at that time. Buyers of put options generate profits as the price of the underlying stock declines below the strike price of the option. Deploying a protective put strategy provides client with a way to protect their wealth from a specified drop in a concentrated position, giving them increased certainty from a wealth preservation perspective.

Hypothetical illustration by Envestnet Research Group.

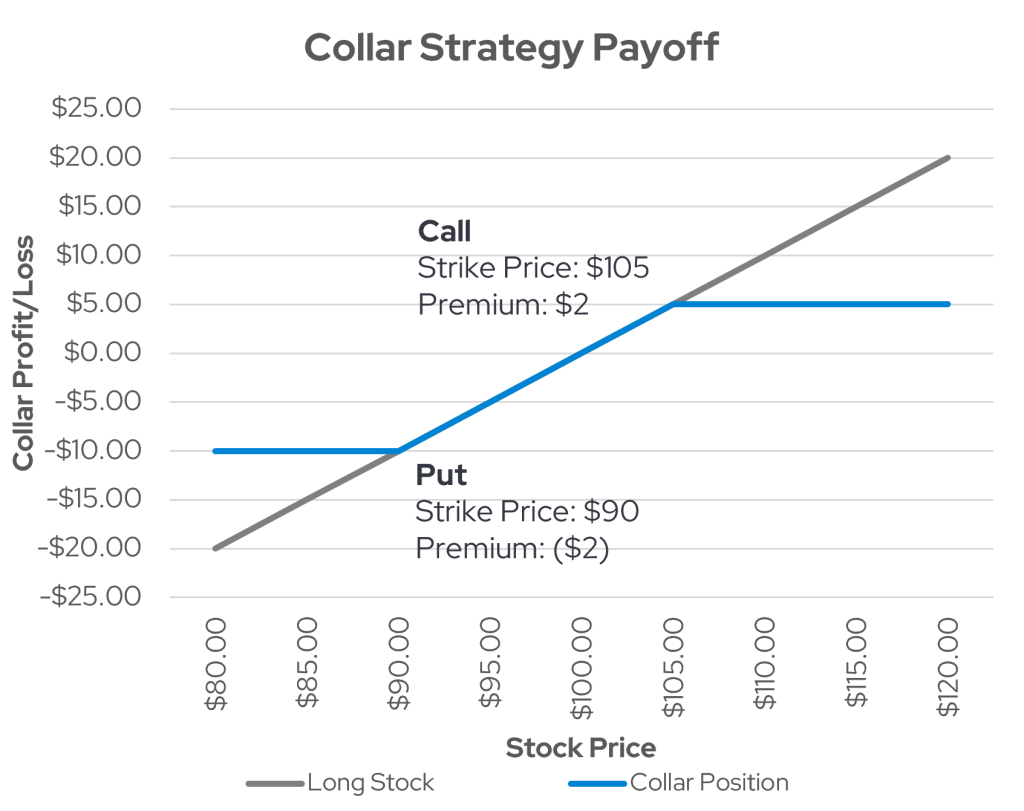

While protective puts can be a great solution for clients looking to protect their wealth, the purchase of puts involves paying the seller an upfront premium for that protection. Paying put premiums can be difficult for clients to digest as they often degrade the return of the security (if it continues to increase) and require available liquidity elsewhere in their portfolio to pay the premiums. The combination of the covered call and protective put strategies into a single approach, called a collar strategy, can be utilized to mitigate this issue for clients. Collar strategies are designed to provide similar downside protection by purchasing puts while simultaneously selling calls to offset the put option premiums. This strategy is often designed as a costless approach where the put option premium is fully offset by the income from the call. The downside to this approach is that the upside potential of the security is capped at the strike price of the calls, but the collar strategy can be a powerful tool for investors looking to protect their financial plan from disaster at a low cost.

Hypothetical illustration by Envestnet Quantitative Research Group.

Explore the potential advantages of options

Whether clients have accumulated concentrated equity holdings through inheritance, employment, or their own trading habits, these positions frequently involve emotional attachment by the shareholders. Hefty unrealized capital gains are often associated with these assets, too. Options may help advisors bring these (typically) held-away stocks onto their books, manage key risks tied to concentrated holdings, and even to generate income from the shares. Maybe most importantly, options-centered strategies can be implemented while the advisor guides the client through a tax-sensitive transition into a diversified portfolio.

By: Hunter Willis, CFP®, CAIA, CFA and Nathan Yates, CIMA®, CETF®

Envestnet | PMC provides independent advisors, broker-dealers, and institutional investors with comprehensive manager research, portfolio consulting, and portfolio management to help improve client outcomes. For more information on Envestnet | PMC, please visit www.investpmc.com.