The investment opportunity set for advisors and their clients has expanded in recent years, particularly with the advent of direct indexing and the emergence of quantitative factor-based investing. Factor-based direct indexing, a modern extension of systematic active strategies long employed by sophisticated institutional investors, offers clients a highly customizable, transparent, and cost-efficient approach. This approach, often referred to as “systematic active” or “quant active” investing, focuses on algorithmically constructing portfolios to capture exposures to well-researched asset-pricing factors such as value, momentum, and quality, and stands in contrast to traditional fundamental active management.

The features of factor-based direct indexing are increasingly being recognized, with potential benefits including enhanced tax optimization and risk management. Advisors who have historically implemented traditional active managers may find these “systematic active” factor-based strategies to be an excellent alternative. This post explores a few of these differences, comparing factor-based direct indexing to traditional active management.

Transparency and objectivity

One of the most distinguishing features of factor-based direct indexing is its emphasis on transparency and objectivity. Quantitative factor-based strategies employ systematic, rules-driven methodologies that rely on empirical data and well-defined criteria. These models optimize portfolios based on certain asset-pricing characteristics, or "factors," which academic and industry research indicate may drive returns over time. Examples of such factors include stocks with lower valuations (value), companies exhibiting strong recent relative performance (momentum), or firms with high relative profitability (quality). These strategies are well-supported by decades of academic research, and because they are grounded in data and follow a clear, algorithmic process, clients have a transparent understanding of how investment decisions are made and what drives performance.

This transparency is in stark contrast to traditional fundamental active management, where investment decisions are heavily influenced by the discretion and judgment of portfolio managers. These managers often base their choices on qualitative research, company visits, and in-depth analysis of business fundamentals. While this approach can yield valuable insights, it also introduces a significant level of subjectivity. Clients may find it challenging to fully understand the rationale behind specific stock picks or the factors influencing portfolio changes. Additionally, traditional active managers are prone to cognitive biases, such as overconfidence and loss aversion, which can affect their decision-making processes.

The objectivity of factor-based direct indexing minimizes the influence of human biases and emotions. By adhering to data-driven and rules-based methodologies, this approach ensures that investment decisions are made consistently, irrespective of market sentiment or short-term noise. Such discipline can be particularly valuable during periods of market turbulence, where emotional reactions often lead to poor investment outcomes. Overall, the clarity and predictability of quant-based strategies can offer peace of mind to clients, who can better understand and anticipate the behavior of their portfolios.

Diversification vs. concentration

Another feature of factor-based direct indexing is the inherent diversification it provides. Traditional fundamental active management often results in relatively concentrated portfolios, with managers placing significant bets on a small number of companies or sectors they have high conviction in. This concentrated approach can lead to outperformance of the benchmark if the selected securities perform well. However, it also increases the risk of material underperformance if just a few key positions do not perform well. The lack of diversification in traditional active portfolios can make them vulnerable to sector-specific or company-specific risks.

In contrast, factor-based direct indexing seeks to diversify across a wide range of securities, providing broad market exposure while tilting the portfolio toward desired factors. This “cross-sectional” approach not only reduces idiosyncratic risk but also enhances the probability of capturing factor-based returns over time. By holding a larger number of securities and perhaps combining exposures to multiple factors, factor-based direct indexing can provide a more balanced risk profile, mitigating the impact of any single stock’s poor performance. Moreover, the systematic rebalancing of the portfolio ensures that factor exposures are maintained consistently, which helps prevent overconcentration in any one area.

Tax optimization

Factor-based direct indexing separate accounts can also offer potential tax optimization benefits over traditional actively managed separate accounts, in part as a result of the greater number of positions typically held. By owning a broader set of individual securities, factor-based direct index portfolios create more frequent opportunities for tax-loss harvesting, a strategy where investments that have declined in value are sold to offset realized capital gains. These potential losses can be used not only to offset gains within the direct indexing portfolio itself but also to reduce the tax impact of gains from other investments the client may hold, such as gains from other separate account managers, mutual funds and ETFs, or even the sale of a business or real estate holdings.

Traditional active management, on the other hand, is often less flexible in terms of tax management. Traditional actively managed separate accounts often concentrate investments in fewer securities, which limits the ability to harvest losses without disrupting the core investment strategy or altering the risk profile of the portfolio.

The systematic and ongoing nature of tax-loss harvesting in direct indexing means that these accounts can be continuously optimized for tax efficiency throughout the year, rather than relying on sporadic opportunities or year-end adjustments. This continuous tax management can improve after-tax returns over time, making factor-based direct indexing an appealing choice for clients seeking to maximize the tax efficiency of their overall investment portfolio.

Enhanced risk management and customization

Factor-based direct indexing also offers risk management and customization options. The systematic nature of quant active strategies allows for precise control over the portfolio's exposure to various risk factors. Benchmark-relative risk can also be mitigated through ensuring that the portfolio is constructed to have sector weightings similar to those of the benchmark index.

Customization is another area where factor-based direct indexing shines. Clients can tailor their portfolios to align with their unique financial goals and values. For example, clients can integrate environmental, social, and governance (ESG) criteria into their direct indexing strategies, excluding companies that do not meet their ethical standards or enhancing exposure to those that do. Alternatively, they can emphasize specific factors or adjust allocations to achieve desired outcomes, such as reduced volatility or enhanced income generation. This level of customization is difficult to achieve with traditional active management, where investment decisions are often made with a broad set of investors in mind.

Traditional active management, while flexible in certain respects, may not offer the same degree of precision and adaptability. Fundamental managers can adjust their portfolios based on their market outlook or research findings, but these changes may not always align with an individual client’s specific preferences or risk profile. Additionally, the discretionary nature of traditional active strategies makes it harder to systematically manage risk, as decisions are influenced by the manager's views and biases.

Cost efficiency

Cost considerations are critical when comparing factor-based direct indexing to traditional actively managed strategies. Systematic active strategies, including direct indexing, typically have lower portfolio management fees due to the automation and efficiency of the investment process. The use of data-driven algorithms reduces the need for large teams of analysts and the costly overhead associated with traditional active management. As a result, clients can often benefit from lower portfolio management fees, which may have a meaningful impact on long-term returns. The compounding effect of lower fees is especially significant over extended investment horizons.

Traditional active management, in contrast, is often expensive. The fees associated with fundamental research and portfolio manager compensation can add up, reducing net returns for clients. And given that a large percentage of traditional active managers struggle to consistently outperform their benchmarks, the high fees can be difficult to justify. In a world where cost efficiency is increasingly important, factor-based direct indexing provides a compelling alternative.

Potential performance benefits

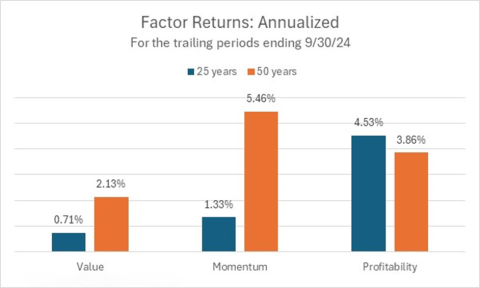

Finally, it is worth noting that the empirical evidence supporting the efficacy of factor-based-direct indexing strategies continues to grow. Research has shown that certain factors, such as value, momentum, and quality/profitability, have historically delivered positive performance over longer time horizons.

By systematically capturing these factor premiums, factor-based direct indexing strategies can offer a robust data-driven, objective and transparent path to potential outperformance. While traditional active managers may periodically achieve notable success, the challenge lies in consistently delivering alpha—a task that has proven difficult for most traditional active managers over the long term.

That said, it is important to recognize that no investment strategy is foolproof. Factor-based direct indexing strategies are not immune to periods of underperformance, particularly if the factors which are being captured fall out of favor. Nonetheless, the transparency, objectivity, diversification, and cost efficiency of this type of systematic active investing make it an appealing option for many clients.

By leveraging transparency, data-driven methodologies, and cost-effective implementation, systematic active strategies such as factor-based direct indexing address many of the shortcomings of traditional active management. The potential benefits of diversification, tax optimization, enhanced risk management, and customization make factor-based direct indexing a compelling option for advisors seeking an alternative to traditional actively managed strategies.

By: Hunter Willis, CFA®, QRG Portfolio Manager, and Brandon Thomas, Managing Principal, QRG

For more information about Envestnet's QPs, which are managed by the company's quantitative asset management unit, QRG Capital Management, Inc., please visit: https://www.envestnet.com/qrg/.