If you’ve been feeling like the RIA industry has undergone more profound changes in the past five years than in its entire history, you wouldn’t be wrong. From industry consolidation to expanding client expectations, a number of evolving trends are requiring registered investment advisors to pause and rethink the way they conduct their business.

You could call these trends challenges, or you could call them opportunities, but either way, understanding and adapting to them is critical for maintaining and growing your practice. We’ll take a closer look at the Top 5 Trends to Power Your Practice in our two-part blog article series.

We’ll begin by highlighting three major RIA market shifts:

Increased consolidation of RIAs

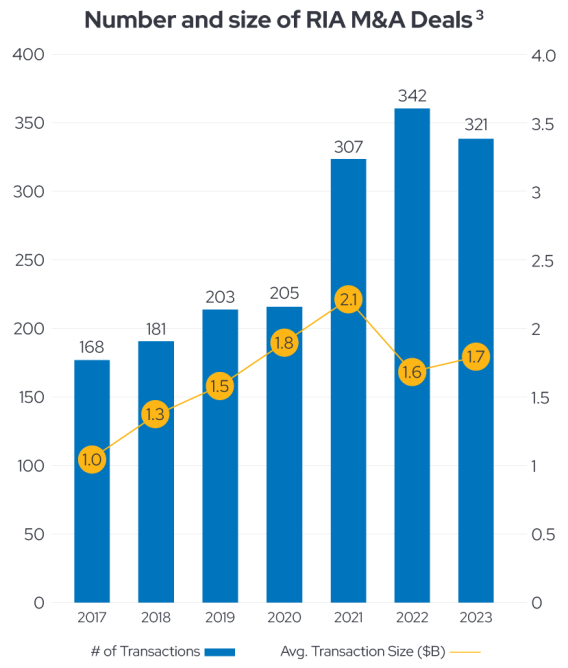

Mergers and acquisitions in the RIA space aren’t anything new, but they hit an all-time high recently. RIA consultancy firm DeVoe reports that October had the highest monthly M&A deal volume on record, nearly double the volume of the previous year.1

Acquisitions don’t show any signs of slowing in the foreseeable future, either. Market research firm Cerulli Associates projects that RIA acquisition activity will reach $3.8 billion over the next five to 10 years.2

As big firms are getting bigger, smaller RIA firms are shrinking in size and number. Mergers and acquisitions, increased competition, and other factors are all playing a role in declining growth. Retirement is also a factor, with Cerulli reporting that over the next decade, 110,000 of advisors – nearly 40% of the overall advisor workforce – plan to retire.4

Advisors who intend to compete and win clients for the long term need a strategic plan for growth to successfully stand out from larger players.

“The convergence of seller and buyer trends is expected to drive M&A activity through the end of the decade, presenting both challenges and opportunities for firms in the RIA space.” 5

RIA Intel, “RIA Market Trends: Buyouts, and the Increasing Role of Private Equity”

New entrants in the RIA channel

As mergers and acquisitions increase, a number of non-traditional players are entering the RIA market bringing substantial capital, sophisticated technology, and operational expertise – often paired with ambitious growth strategies. Many of these new players are leveraging economies of scale and advanced digital capabilities to serve previously untapped market segments like younger, tech-savvy investors.

One way new entrants are serving more clients with less overhead is through artificial intelligence (AI). Emerging technology is automating and enhancing everything from appointment scheduling to portfolio construction. Investors are becoming more accustomed to AI, too. Nearly 50% of Americans in a Newsweek survey say they’ve used AI to help them invest or manage their money.6

While digital advice platforms and robo advisors could be considered threats to RIA businesses, research shows that 93% of investors with human advisors still prefer to maintain a relationship with their human advisor.7 Nevertheless, these new models require RIAs to innovate and adapt in order to remain competitive.

“By 2030, as advice becomes increasingly analytics-driven and automated, advisors will shift their focus to comprehensive planning beyond the portfolio. As a result, the number of advisors will drop by up to a fifth.” 8

McKinsey & Company, “On the Cusp of Change: North American Wealth Management in 2030”

Fee compression

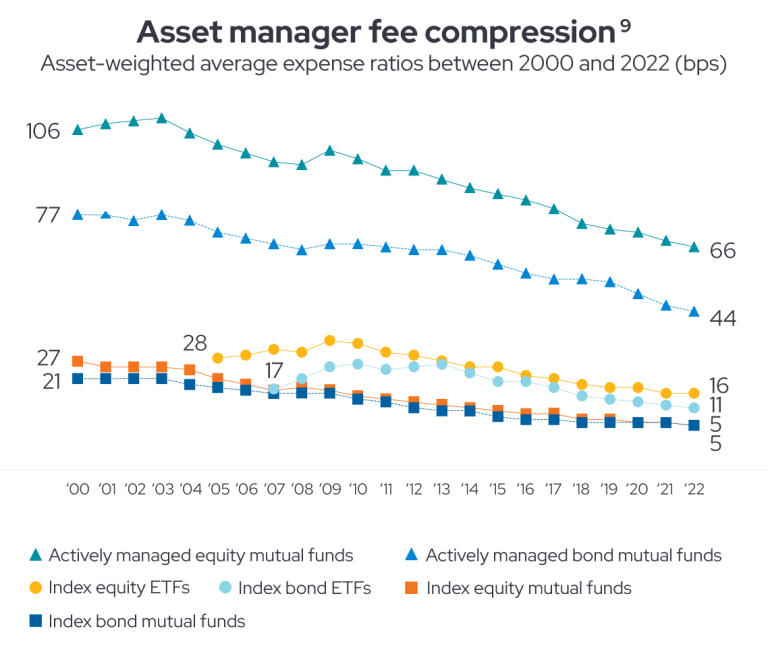

The new entrants in the advice field, investors’ growing fee sensitivity, and a migration to passive funds are all putting downward pressure on advisor fees, and advisors who rely on fees as a significant portion of their revenue are understandably concerned.

In addition, since 2021, RIA expenses have increased, which is also impacting firms' profitability and advisor productivity.10

As RIAs generally charge clients either an hourly or a flat fee to dispense advice or a percentage of their assets under management (AUM), fee compression threatens revenue streams and profit margins. To counteract fee compression, advisors have to generate additional AUM to keep revenue flat. This requires finding ways to bring in new assets and identifying additional sources of income.

Adapting to market trends to drive business growth

Given the heightened competition and increased market pressure, RIAs have to adopt and execute forward-thinking approaches to secure their place in tomorrow’s market.

Here are a few strategies to help you not only compete, but thrive, in the face of competitive market pressure:

Use technology to scale your practice

While new entrants in the advice field and the rise of passive investing may have driven fees down, technology offers a solution. Why not use it the way new entrants are? By leveraging wealth management technology to enhance productivity and streamline operations, advisors at firms of all sizes can serve more clients, more efficiently, while maintaining profitability. Technology allows advisors to connect today’s and tomorrow’s finances.

Build a team-based approach

Offloading investment management tasks can free up time to devote to business development and client-facing activities. With a team-based approach, you can deliver more services, resources, and capabilities and grow AUM without needing to build skills in-house or increase operational workloads.

Optimize your marketing strategy

Enhancing your marketing strategies and your marketing itself is essential for attracting new clients and retain existing ones. Digital marketing, social media engagement, and in-person events are key to these efforts.

Shine a light on fees

Fees and billing are some of the most sensitive touch points within the advisor-client interaction. While real estate and the wealth management industry may seem worlds apart, a recent $418 million settlement by the National Association of Realtors over inflated home sale commissions serves as a reminder of the importance of transparent billing practices.11 Simple, easy to understand fee structures and professional billing statements can help clients understand the fees they are paying and enable RIAs to uphold their fiduciary responsibilities.

Augment your offerings

It’s hard to compete with rock-bottom fees, but by expanding their services, advisors can operate more profitably, regardless of how much clients are paying. RIAs who integrate tax and estate planning, banking advice, life insurance planning, and other services into their practices can deliver more value and better justify fees.

Become a thought leader

Clients want to do business with respected and informed industry leaders. Establishing yourself as a recognized expert can be a valuable way to grow your practice and transcend fee compression. Consider starting a blog or contributing guest articles, launching or serving as a guest speaker on a podcast, or even writing a book to build your professional reputation. Engaging with community organizations, speaking at industry events and on webinar panels, and joining professional boards can all expand your visibility.

Prepare for the future of wealth management

When it comes to wealth management, you don’t have to navigate the changing RIA landscape alone. Our technology, solutions, and intelligence work together to help you identify opportunities, avoid pitfalls, and drive business growth for the long term. As a leader in the industry for well over 20 years, our industry experience and specialized solutions can help equip advisors to enhance financial wellness while tackling the business challenges of tomorrow, today.

View the full whitepaper: Top 5 Trends to Power Your Practice. To see firsthand how Envestnet can help your RIA Practice, visit: envestnet.com/ria.