As client expectations increase and competition grows, financial firms and their advisors are under pressure to offer more services to a broader set of clients. Mergers are one way they’re accomplishing this. But they’re not the only way. Leveraging a network of trusted specialists to deliver more value, improve efficiency, and better manage time, offers a more accessible and scalable alternative for firms of all sizes.

While team-based investing isn’t new in financial services, it’s becoming more prevalent and more important than ever. By tapping external solution providers, RIAs can expand and enhance their practices beyond traditional portfolio management while maintaining control over client relationships.

The role of financial advisors has expanded

Traditionally, financial advisors were primarily focused on portfolio management and investment advice. But, as clients’ financial lives grow to be more complex, they increasingly seek services beyond the traditional scope, like charitable giving strategies, estate planning, tax optimization, and more.

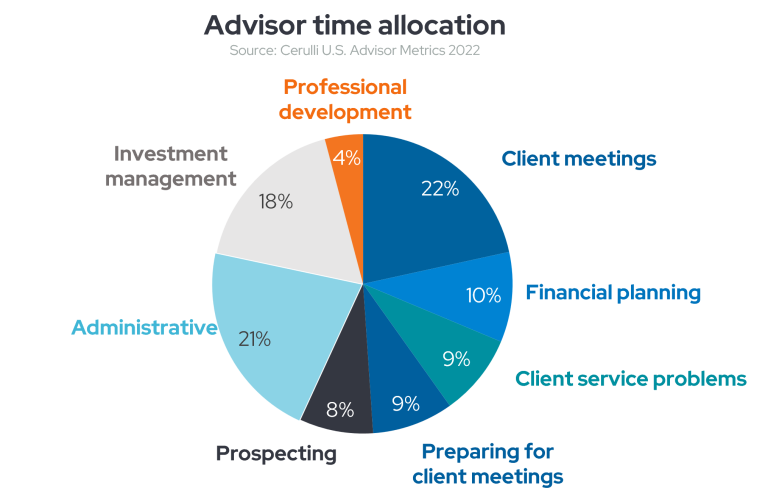

While advisors are expected to deliver more, time is scarce. Today, 39% of advisors’ time is generally spent on investment management and administrative tasks.1 Spending so much of the day on management and back office work limits an RIA’s ability to focus on revenue-generating activities like acquiring new clients and growing existing relationships.

While expanding services can drive AUM growth, acquiring niche expertise, staying on top of compliance requirements, and providing personalized advice to each client can be challenging and time consuming.

4 reasons to consider a team-based approach

Similar to how a general contractor relies on specialized subcontractors, financial advisors can turn to a network of trusted specialists to deliver more value to clients, improve operational efficiency, and better allocate their time. The benefits of team-based approaches include:

- Increased capabilities and growth opportunities: By partnering with external specialists in areas like legal and trust, technology, taxes, and marketing, firms can increase and enhance the services they offer to attract new clients and service existing clients more effectively.

- Depth of expertise: No single advisor can master all areas of wealth management. Tapping into a team of specialists with unparalleled experience and knowledge can enable advisors to solve more complex financial challenges for their clients and create a better client experience.

- Holistic planning: Advisors today are becoming more like integrated life/wealth coaches who advise clients on financial matters related to life milestones and more. By partnering closely with experts, advisors can develop a cohesive and integrated financial plan for clients and address their unique and complex needs while maintaining control over the overall financial planning process.

- Greater growth: Studies consistently show that advisors who offer a larger variety of services experience significantly higher growth in assets under management (AUM), revenue, and clients.2 High-growth advisors often offer as much as 10 or more different services, including estate and tax planning, that match the needs of high net worth clients.3

A team-based approach for investing pays

Financial advisors who outsource portfolio construction and investment management are better able to scale their practices and provide more consistent investment management outcomes. In fact, 98% of advisors who use a team-based approach to investment management report they are delivering better investment solutions as a result, according to a survey by AssetMark.4 The ability to seamlessly integrate specialized investment expertise allows advisors to grow their assets under management more efficiently and serve a larger client base – without sacrificing quality of service.

Team-based approaches to investing also help distribute and mitigate investment and operational risks, such as key personnel risk and trading errors. By tapping into third party expertise, firms can reduce the likelihood of non-compliance with regulatory requirements.

Outsourcing portfolio management can save significant amounts of time – around nine hours a week, according to a recent study.5 These hours can be spent on building relationships with clients, business development, and other growth-related activities.

Enhancing services and achieving consistent results with model portfolios is also shown to boost AUM, with advisors who offer model portfolios experiencing as much as 300-500 bps AUM growth.1

How to get started with a team-based approach

Outsourcing isn’t an all-or-nothing decision. You can get help with basic administrative tasks or have others execute portfolio strategy on your behalf. Here are a few best practices:

Consider key areas for expansion. Leveraging outside expertise in critical areas can help you better meet clients’ needs without increasing your workload or adding internal staff. Many advisory practices benefit by extending their investment team in these four key areas:

- CMAs and asset allocation

- Manager research and selection

- Trading

- Portfolio construction

To determine how and where to supplement your practice, evaluate your specific needs, business goals, strengths, and desired level of control.

Start small. Consider a phased approach. Begin with low-revenue and either low or high-demand clients to test out the team-based approach. Do it for 12 months and then measure the results. As confidence grows, you can expand to include more clients.

Tailor to fit. Graduate to different personas based on your business model and the unique demands of different client segments.

Consider proven tools and solutions: You don’t have to spend years building partnerships and coordinated solutions. Instead, you can choose from a variety of investment management tools, services, and platforms designed to facilitate a team-based approach and make it easier to implement.

Reinvest your time. Reimagine how you can allocate the time you’ve gained due to outsourcing. Then reinvest that time and your skills to grow your business.

Maximizing the RIA advantage

A team-based approach can help RIAs looking to drive business growth and deepen client relationships. Through partnerships, you can deliver more services, resources, and capabilities to clients and grow AUM without needing to build skills in-house or increase operational workloads.

Offloading investment management tasks to trusted providers enables RIAs to work smarter, not harder, helps eliminate risk, and frees up time to focus on client-facing activities. By addressing clients’ specific needs, challenges, and goals through a team-based approach, RIAs can complement their own skills and position their practices for long-term success.

Explore a team-based strategy for scaling your business and delivering more value to clients at www.envestnet.com/rias.