Envestnet | PMC is an industry pioneer in blending the two opposing investment styles: active and passive. We have been implementing this approach within client portfolios well before the asset flow dominance into passive vehicles in recent years. This investment methodology is embedded in our DNA. We leverage Envestnet | PMC’s core competencies of manager research and due diligence, manager selection, asset allocation, and active/passive research to engage with our clients. We know active management is cyclical, but we are firm advocates of active strategies. We recognize the benefits of passive investing, too.

Market overview

In the third quarter of 2024, financial markets navigated a whirlwind of uncertainty, but rather than succumbing to chaos, they demonstrated surprising resilience and strength. Despite geopolitical tensions and fluctuating economic signals, equity markets maintained their upward trajectory, with major indices closing the quarter in positive territory. The S&P 500 Index gained 5.9% for the quarter, contributing to an impressive year-to-date gain of over 22%. Small-cap stocks, represented by the Russell 2000 Index, also rebounded, benefiting from the Federal Reserve’s (Fed) monetary easing and outperforming large caps toward the latter part of the quarter. Notably, there was a shift from growth to value stocks, reflecting a rotation in investor sentiment as economic data showed signs of improvement, including stronger-than-expected GDP growth and easing inflation pressures. Global markets followed suit, particularly emerging economies, with China's stimulus package boosting its equities and contributing to an overall strong quarter for emerging markets. Fixed income markets also experienced notable shifts, with the Fed’s 50-basis point rate cut in September marking the start of a new easing cycle. Treasury yields fell across the curve, and the inverted yield curve began to "bull steepen" as short-term rates declined faster than long-term ones. This easing monetary environment helped bond investors recover from earlier challenges, delivering improved returns for both government and corporate bonds. The outlook for fixed income remains favorable, with further rate cuts expected in 2025.

Our scorecard

Our ActivePassive Scorecard shows active funds beating their category benchmarks in three of the 19 asset classes we tracked for the third quarter. Year-to-date, active funds are leading their category benchmarks in six of these analyzed asset classes. Over the last 12 months, active funds have outperformed in four of these asset classes.

The third quarter was a challenging time for active managers as they topped our category benchmarks in only 16% of the asset classes we track. Through the first three quarters of 2024, active managers are ahead in just under one-third of the asset classes tracked for this scorecard. Over the past twelve months, active managers beat 21% of these category benchmarks. Let’s delve into the details of our scorecard.

U.S. Equity

| Active Fund Category | Qtr Return | Vs. Benchmark | YTD Return | Vs. Benchmark | TTM Return | Vs. Benchmark |

|---|---|---|---|---|---|---|

| Large Cap Core | 5.73% | -0.35% | 19.12% | -2.06% | 32.50% | -3.18% |

| Large Cap Growth | 3.63% | 0.44% | 22.01% | -2.54% | 39.03% | -3.16% |

| Large Cap Value | 7.72% | -1.71% | 15.65% | -1.03% | 26.73% | -1.03% |

| Mid Cap Core | 8.49% | -0.72% | 14.24% | -0.39% | 27.41% | -1.92% |

| Mid Cap Growth | 6.52% | -0.02% | 12.55% | -0.37% | 26.31% | -3.02% |

| Mid Cap Value | 8.72% | -1.36% | 12.75% | -2.33% | 25.37% | -3.65% |

| Small Cap Core | 8.06% | -1.21% | 11.17% | 0.01% | 24.72% | -2.05% |

| Small Cap Growth | 7.34% | -1.07% | 12.94% | -0.29% | 25.82% | -1.84% |

| Small Cap Value | 7.86% | -2.29% | 9.24% | 0.03% | 22.80% | -3.08% |

Data from Morningstar as of 9/30/2024. The Morningstar US Active Fund categories used in this analysis represent U.S.-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Russell 1000 TR USD, Russell 1000 Growth TR USD, Russell 1000 Value TR USD, Russell Mid Cap TR USD, Russell Mid Cap Growth TR USD, Russell Mid Cap Value TR USD.

Actively managed U.S. equity funds struggled during the third quarter. While U.S. equity markets saw gains become less concentrated in large cap technology stocks during the quarter, active managers generally struggled to top key benchmarks. In fact, only large cap growth managers, which have rarely outpaced their benchmarks during the year, scored a win, in aggregate. As the Magnificent 7 stocks stumbled a bit during Q3, their heavy Russell 1000 weights made that index easier to beat. (The Magnificent 7 stocks are Alphabet (GOOGL and GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA).)

While Q3 proved challenging for U.S. active managers overall, many differentiated strategies found success. In the large cap value space, the high income/more defensive value strategies were strong in the quarter. Real Estate Investment Trusts (REITs) and Utilities were the best performing equity market sectors in Q3, while Technology was the second worst (next to Energy). This combination of sector returns was advantageous to strategies that emphasize income and defensive positioning. Meanwhile, the managers that straddle the boundary of value and core allocations largely underperformed in Q3. Quite a few of these strategies have been overweight technology stocks the last few years, which caused weaker relative performance last quarter. (The Russell 2000 Value’s allocation to technology stocks is just 7%,1 but some value strategies have 10–15% allocations to the technology sector.)

In the small cap space, high beta stocks outperformed in Q3. This trend was a headwind for most active managers. Regional banks outperformed significantly, which could be a headwind or tailwind for active managers depending upon their positioning, but many managers are underweight or equal weight. (Regional banks account for ~10% of the Russell 2000 and nearly doubled the index’s return in Q3, +17.3% vs. +9.3%.)2 The outperformance of the REITs sector in Q3 was also impactful for many small cap managers depending upon their over/underweight positioning.

Over the longer term, active small cap core and value have eked out minor aggregate outperformance year-to-date, but active managers across the U.S. equity asset classes tracked in our scorecard have collectively underperformed over the last twelve months. While many managers have excelled over the past year, the environment has proven to be difficult for stock-picking. Time will tell whether equity market trends will lead to improved opportunities for active management success.

Non-U.S. Equity

| Active Fund Category | Qtr Return | Vs. Benchmark | YTD Return | Vs. Benchmark | TTM Return | Vs. Benchmark |

|---|---|---|---|---|---|---|

| Developed Markets | 7.25% | -0.02% | 13.11% | 0.12% | 24.11% | -0.66% |

| Emerging Markets | 5.83% | -2.89% | 13.38% | -3.48% | 22.60% | -3.46% |

Data from Morningstar as of 9/30/2024. The Morningstar US Active Fund categories used in this analysis represent U.S.-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in the order of table): MSCI EAFE NR USD and MSCI EM NR USD.

Looking at non-U.S. equity markets, we find that active managers saw relatively stronger performance in developed markets than in emerging markets during Q3. Still, active managers failed to top the key benchmarks for developed and emerging markets, in aggregate. Developed markets enjoyed a quarter of strong returns as many major central banks eased monetary policy. This environment allowed active managers to collectively come within two basis points of matching the MSCI EAFE index’s return. Emerging markets, meanwhile, finished Q3 with a strong upswing in Chinese stocks, with the MSCI China index jumping 23.6% in the quarter.3 Most of this gain occurred in last week of September, and it was detrimental to active managers that were underweight Chinese equities. Emerging markets active managers fell far short of the MSCI EM in aggregate last quarter in this environment.

Year-to-date, we see that developed markets active strategies have collectively outperformed, but emerging markets strategies have been challenged overall. Much of the underperformance in the latter asset class can be traced to Q3, though. The same is true for trailing twelve months (TTM) results for active emerging markets funds. Developed markets active managers have also underperformed the key benchmark for their asset class over the last year but by a relatively small amount. Emerging markets have been far more difficult for active strategy success.

Fixed Income

| Active Fund Category | Qtr Return | Vs. Benchmark | YTD Return | Vs. Benchmark | TTM Return | Vs. Benchmark |

|---|---|---|---|---|---|---|

| Intermediate Bond | 5.02% | -0.17% | 4.79% | 0.34% | 11.59% | 0.02% |

| Short-Term Bond | 3.12% | 0.16% | 5.20% | 0.79% | 8.69% | 1.45% |

| Intermediate Muni | 2.47% | -0.57% | 2.95% | 0.72% | 9.49% | 1.93% |

| High Yield | 4.29% | -0.99% | 7.37% | -0.63% | 13.91% | -1.83% |

Data from Morningstar as of 9/30/2024. The Morningstar US Active Fund categories used in this analysis represent U.S.-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Bloomberg US Agg Bond TR USD, Bloomberg US Agg 1-3 Yr TR USD, and Bloomberg Municipal 5 Yr 4-6 TR USD, Bloomberg US Corporate High Yield TR USD.

Fixed income investors cheered a strong third quarter as the Federal Reserve began its long-awaited cycle of interest rate cuts. Bond markets endured volatility at the start of August and September but ultimately finished the quarter with positive results. Fund managers saw mixed success in beating key fixed income indices, though. While active managers enjoyed collective Q3 benchmark outperformance in short-term bonds, they fell short in our scorecard’s other fixed income categories. Overall, Q3 largely rewarded strategies that tilted toward longer duration securities and attractive credit opportunities. Reaching for high yield bonds didn’t generate the extra returns found in that niche earlier this year, though. Instead, investment-grade securities were strong during Q3.

While active managers only outperformed in 1/4 of the major fixed income categories for the quarter, they have shown greater aggregate success over longer periods. For the YTD and TTM timeframes, active managers have beaten ¾ of our fixed income asset class benchmarks. Bond markets have historically been challenging for passive funds due to the sheer number of unique fixed income securities available, and this situation can help active management. Outside of high yield bonds, active strategies have generated excess aggregate returns this year and over the past twelve months. These results may change as the Federal Reserve considers further rate cuts, but many active bond strategies have earned their keep so far in 2024.

Diversifying Asset Classes

| Active Fund Category | Qtr Return | Vs. Benchmark | YTD Return | Vs. Benchmark | TTM Return | Vs. Benchmark |

|---|---|---|---|---|---|---|

| Commodities | 0.30% | -0.38% | 5.86% | 0.00% | 1.71% | 0.75% |

| Real Estate | 15.75% | 0.19% | 14.17% | -0.75% | 32.43% | -1.28% |

| TIPS | 3.94% | -0.18% | 4.61% | -0.24% | 8.89% | -0.91% |

| Bank Loan | 2.03% | -0.02% | 6.13% | -0.41% | 9.29% | -0.30% |

Data from Morningstar as of 9/30/2024. The Morningstar US Active Fund categories used in this analysis represent U.S.-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Bloomberg Commodity TR USD, DJ US Select REIT TR USD, BBgBarc US Treasury US TIPS TR USD, and Morningstar LSTA LL TR USD.

Finally, let’s turn to diversifying asset classes. In these investment niches, only real estate active managers generated excess Q3 returns, in aggregate. REITs boomed in the quarter, and active strategies in the sector rode the wave higher. In the other three diversifying asset classes presented above, however, active managers didn’t collectively outperform key benchmarks. Falling oil prices, inflation, and interest rates, affected commodity, Treasury Inflation-Protected Security (TIPS), and bank loan funds, respectively. These shifts didn’t help active managers overall.

Over the YTD and TTM timeframes, only active commodity strategies are exhibiting benchmark-meeting, or beating, overall returns. In the other three diversifying asset classes tracked by this scorecard, active managers have struggled over the longer periods. These asset classes can have idiosyncratic return patterns, though, offering top active managers the opportunity to excel.

Factor update

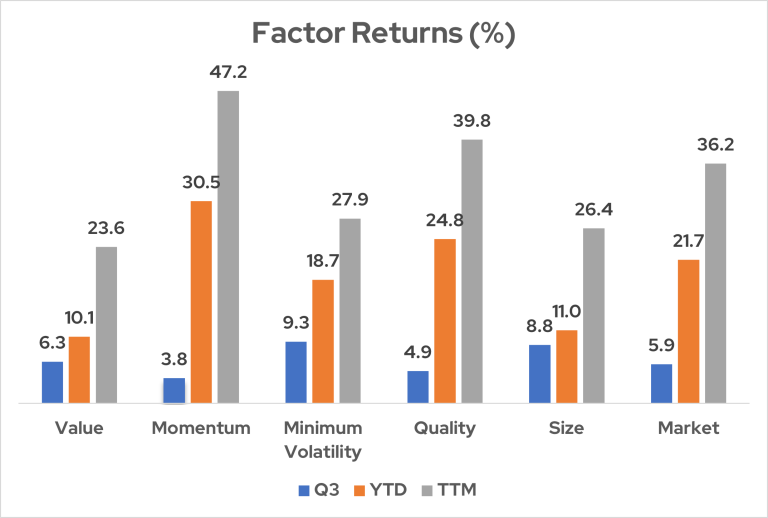

Below, we examine the performance of the five key factors (described by the infographic) in the current market environment.

These indices represent U.S. factor returns: MSCI USA Enhanced Value, MSCI USA Momentum, MSCI USA Minimum Volatility, MSCI USA Quality, MSCI USA Small Cap, and MSCI USA GR USD. As of 9/30/2024. Data source: Morningstar.

- Q3 delivered positive returns for all the key factors tracked in this scorecard.

- The Minimum Volatility and Size factors led the way in the quarter as utility stocks (which historically have limited fluctuations) and small caps outperformed.

- The Value factor also performed well and rose 6.3% in Q3. As U.S. equity market gains broadened, value stocks were able to somewhat catch up to growth stocks.

- The Momentum factor was the Q3 laggard, however, as shifts in market leadership impacted its performance.

- Over the YTD and TTM timeframes, the Momentum and Quality factors remain the clear leaders. Relatively consistent and strong gains from large cap technology stocks have powered these factors higher.

The power of both active and passive management

This update on active and passive management covers a relatively short timeframe, but Envestnet | PMC has a long history of research and portfolio management using our ActivePassive methodology. This framework requires patience and a deep understanding of cyclical trends. Ultimately, though, we believe there is a place and a time for both active and passive management.

For more information on Envestnet | PMC, please visit www.investpmc.com.