In recent years, significant strides have been made in recognizing the needs and celebrating the contributions of the LGBTQ+ community. As we reflect on the progress toward equality and the vital role LGBTQ+ individuals have played in our society's history, it is also a good time to address their financial planning needs.

A recent study showed that LGBTQ+ adults are more likely than the average American to feel like they are not doing well financially, at 48% vs. 26.9%, respectively. And in another survey, 62% of LGBTQ+ investors indicated they are facing financial challenges due to their unique needs in areas like adoption and estate planning.1 They reported actively seeking advisors who can assist them in these areas, presenting a substantial growth opportunity for advisors to demonstrate value and help clients in an underserved segment. Bridging this gap requires a nuanced understanding of their unique financial preferences, goals, and challenges.

The opportunity with LGBTQ+ investors

It is widely accepted that the LGBTQ+ community has higher disposable income and growth-friendly consumption patterns, making them a significant demographic for financial advisors to consider. The LGBTQ+ community commands an estimated $4.7 trillion in annual purchasing power in the U.S., with a global household wealth estimated at $30 trillion.2 Adding to that, a Wells Fargo study found correlations between higher populations of lesbian, gay, bisexual, and transgender people in U.S. states and increased economic growth in those states.3 Advisors who are focused on high-net-worth investors in their business planning efforts have an opportunity when looking at this underserved segment.

Understanding and earning trust with the LGBTQ+ investor

As with any potential client group or investor subset, the first step to serving an investor is to understand them. This begins with education, to ensure you and your colleagues grasp the unique financial needs and sensitivities of LGBTQ+ investors.

To better serve this investor base, advisors need to recognize their unique approach to risk, investment goals, diversification, legacy planning and financial education. Trust in advisors is essential within this demographic, with a survey showing that three in ten (30.8%) LGBTQ+ adults have experienced discrimination while accessing financial services.2

There are also plenty of online resources, services and groups that can help educate financial advisors on the needs of the LGBTQ+ community, so advisors can continue to be more inclusive with their services and offerings. Here are examples:

- A guide to planning for LGBTQ+ individuals and couples, provided by the CFP Board of Standards.

- Morningstar recently published the following report: Key Statistics About Income and Wealth for the U.S. LGBTQ+ Population

Family, legacy, and healthcare considerations for the LGBTQ+ investor

For LGBTQ+ investors who would like to have a family or grow their family, adoption can be a lengthy legal process and a deeply personal, financial journey. Advisors can play a role in guiding LGBTQ+ clients through financial complexities, which can include agency adoption costs and attorney’s fees for second-parent adoptions, and potential ways to help address challenges along the way— such as adoption tax credits, marriage tax exemptions, legacy planning considerations and family building grants— ensuring their family planning aligns with their financial goals.3

Despite significant strides in legal recognition, navigating adoption processes can still present challenges and provide financial obstacles for these families, highlighting the need for tailored financial advice and planning. While adoption through public programs can be affordable or free, private or international adoptions may range from $20,000 to $50,000. For those considering surrogacy, expenses range significantly from $60,000 to $150,000.4

As your clients’ family grows, thoughtful estate planning is especially crucial for married same-sex couples and families. Following the 2015 U.S. Supreme Court decision legalizing same-sex marriage, these couples can now access estate planning strategies previously unavailable to them. Advisors play a critical role in helping LGBTQ+ clients and their spouses effectively plan for and safeguard their interests and legacies.

Navigating healthcare and long-term care is another area where LGBTQ+ HNW investors can benefit from informed guidance from advisors. Not all states or communities have eldercare and healthcare facilities that adequately or sensitively address the needs of LGBTQ+ individuals. Advisors can help them plan for the financial realities of such a facility during comprehensive financial planning sessions.

Values-based investing and education

With LGBTQ+ investors, there is a significant opportunity to integrate Environmental, Social, and Governance (ESG) criteria with their investment portfolios to ensure they align their financial goals with personal values. It is important to note that the demand for such products extends beyond the LGBTQ+ community. Research suggests investors born after 1980 are particularly interested in investment opportunities that seek to advance equity and inclusion.

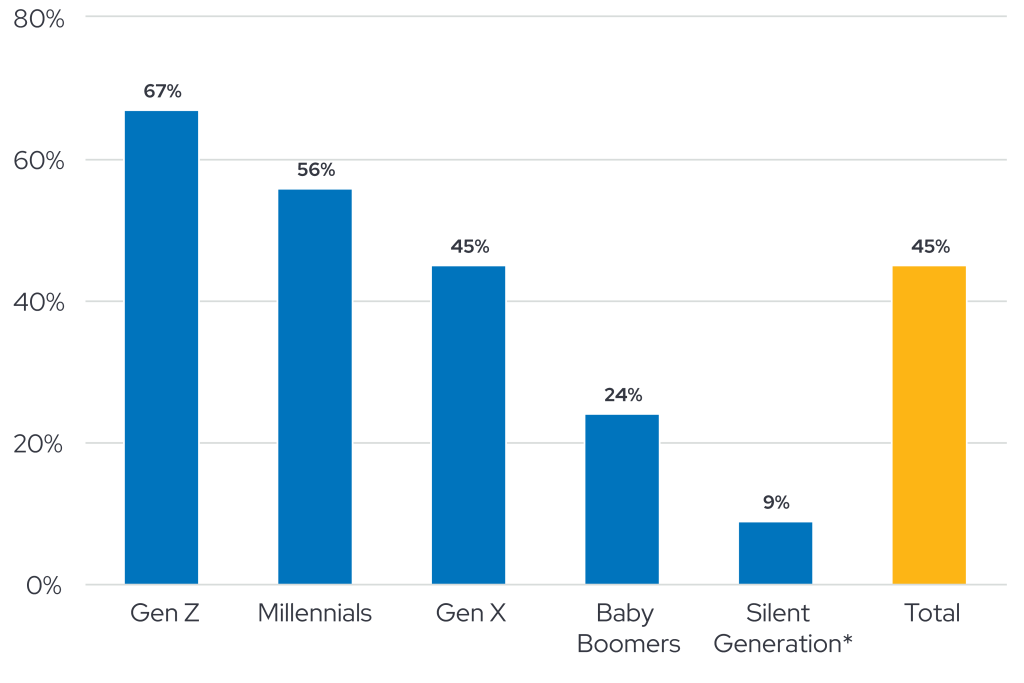

How interested are you in finding investment products or strategies that seek to advance LGBTQ+ equity and inclusion?

Age ranges: Gen Z: 18-26, Millennials: 27-42, Gen X: 43-58, Baby Boomers: 59-77, Silent Generation: 78-80. Respondents who answered Very or Somewhat Interested. *Denotes a small sample size

Despite the investor interest, such investment options today are limited. Among interested investors, 42% highlighted a lack of LGBTQ+ equity investment opportunities. Nearly a third did not know how to invest in this theme (32%) and lacked research or data on the theme (31%).5

This demand, combined with the lack of access/information, creates opportunities for asset managers to differentiate themselves among investors within and beyond the LGBTQ+ community. The majority of LGBTQ+ investors (80%) and a significant portion of non-LGBTQ+ investors (40%) consider LGBTQ+ equity an important factor when choosing a financial advisor or platform. Furthermore, 80% of LGBTQ+ investors and 31% of non-LGBTQ+ investors would change their financial advisor or investment platform to one that offers better LGBTQ+ equity and inclusion opportunities.6

Retirement planning for the LGBTQ+ investor

According to Employee Benefit Research Institute survey data cited by Morningstar, LGBTQ+ adults, across income levels, are less confident about having enough money to live comfortably in retirement. LGBTQ+ adults also expect to retire at older ages than their non-LGBTQ+ counterparts. According to the Employee Benefit Research Institute survey:

- 60% of LGBTQ+ retirees retired earlier than planned4

- 47% of non-LGBTQ+ retirees retired earlier than planned5

As advisory practices become more holistic in the breadth of advice and services offered, incorporating retirement planning for HNW investors, including a focus on the unique retirement needs of LGBTQ+ investors, can help address a fuller picture of the client’s needs. By bringing retirement planning into view alongside other investments in a client’s portfolio, investors have a more complete financial picture, to help them make more informed financial decisions for the short- and long-term.

Building relationships to last a lifetime

No two clients are identical, of course, but understanding the general concerns and needs of LGBTQ+ investors—and knowing how to adjust financial plans accordingly that are tailored to their specialized needs and goals—can set advisory practices up for success.

By staying informed on legal policies and statutes, social trends and developments affecting the LGBTQ+ community—and making an ongoing conscious effort to foster trust through inclusive practices—you can build lasting relationships with this underserved investor segment. As the industry continues to evolve, embracing diversity and learning how you and your colleagues can tailor your offerings to meet the distinct needs of these clients will lay the groundwork for strong relationships with LGBTQ+ individuals, couples and families, and power more growth for your practice.

For further insights, explore these additional resources:

- LGBTQ+ Financial Support and Resources (moneygeek)

- Resources to Help You Understand the LGBTQ+ Landscape (The UHNW Institute)

- The LGBTQI+ Economic and Financial (LEAF) Report (The Center for LGBTQ Economic Advancement & Research (CLEAR))

- 2024 LGBTQ+ Financial Wellness Report (hrc-prod-requests.s3-us-west-2.amazonaws.com) - Human Rights Campaign Foundation

Visit https://newsroom.envestnet.com/ to access our research, perspectives from industry experts, and the latest news from Envestnet.