High-net-worth investors (HNWIs), i.e., investors with over $1 million in investable assets, want to feel like they are your most important clients. They want access to sophisticated investment options and services. They expect everything you suggest to be customized to meet their specific needs. Ultimately, they want to feel valued beyond just being a part of your book of business; they want your team to support their entire family’s financial well-being.

To that end, we’ve identified four pillars of delivering a hyper-personalized HNW client retention strategy that your team can implement to help meet the specific needs of your clients.

- Deliver educational support

- Broaden your value proposition

- Personalize tax management

- Use actionable data for values alignment

Let’s examine each strategy and some actionable tactics that you can implement in your own advisory practice.

4 pillars of HNW client retention

1. Deliver educational support

Positioning yourself as a reliable, accurate, and knowledgeable source of financial information is a powerful way to deliver value to your clients. When clients believe that you have the best information, they won’t need to search elsewhere for it. Ideally, you’d like your clients to think, “I need to make a decision about X… I better reach out to my wealth manager to understand my options.”

Practically, educational support can take several forms depending on your practice.

- Current market outlooks and commentaries—Setting up blogs or resource libraries on your website can create a valuable, curated information hub for your clients to access on demand. This content can also be repurposed into monthly or quarterly newsletters that are delivered directly to your clients’ inboxes.

- Specific investing themes—When presenting recommendations to clients, organize them into investing themes or categories. Examples might include:

- The benefits of staying invested for the long-term (e.g., time in the market vs. timing the market)

- Portfolio allocation considerations during rising interest rates

- Value vs. growth

- How missing the best days in the market can impact portfolio returns

This structure can really enhance the conversations you have with your clients. They’ll walk away both knowing more than when they arrived and also understanding the thought process behind your recommendations.

- Appropriate product expectations—Clients will often complain to their advisors when their portfolio doesn’t have the same performance as the market. Advisors have an opportunity to set proper expectations around:

- The products your clients are invested in and how they align with their suitability/ risk questionnaires

- The potential benefits of sticking with their portfolio and how movement during times of volatility could affect meeting their financial goals

- When you would recommend making movements

Setting clear expectations sets your relationship with your client up for success. This is an opportunity to enhance your clients’ understanding of investing and wealth management, enabling them to make informed decisions. It is also an opportunity to increase transparency, which ultimately builds trust.

“39% of millennial HNWIs switched providers in the past year due to a lack of transparency… they demand greater digital interaction, education, and convenience.” 1

Tip: Explain “timing the market” vs. “time in the market”

Writing a slide, email, or short blog post about the difference between “timing the market” and “time in the market” is a great place to start. You might use a simple analogy like…

- Timing the market: Trying to jump on and off a roller coaster at the perfect moments to enjoy the best parts of the ride.

- Time in the market: Planting a tree and letting it grow over years, benefiting from its growth over a long period of time.

Advisors spend a significant amount of time with their clients, recommending a portfolio tailored to meet their specific goals while considering their risk and suitability profiles. Ultimately, attempting to time the market undermines this plan and may cause deviations in a client meeting their goals.

2. Broaden your value proposition

The second pillar of our hyper-personalized HNW client retention strategy is to offer an expansive selection of products and services. You want clients to see you as a wealth management “one-stop shop” rather than just someone to call about investments.

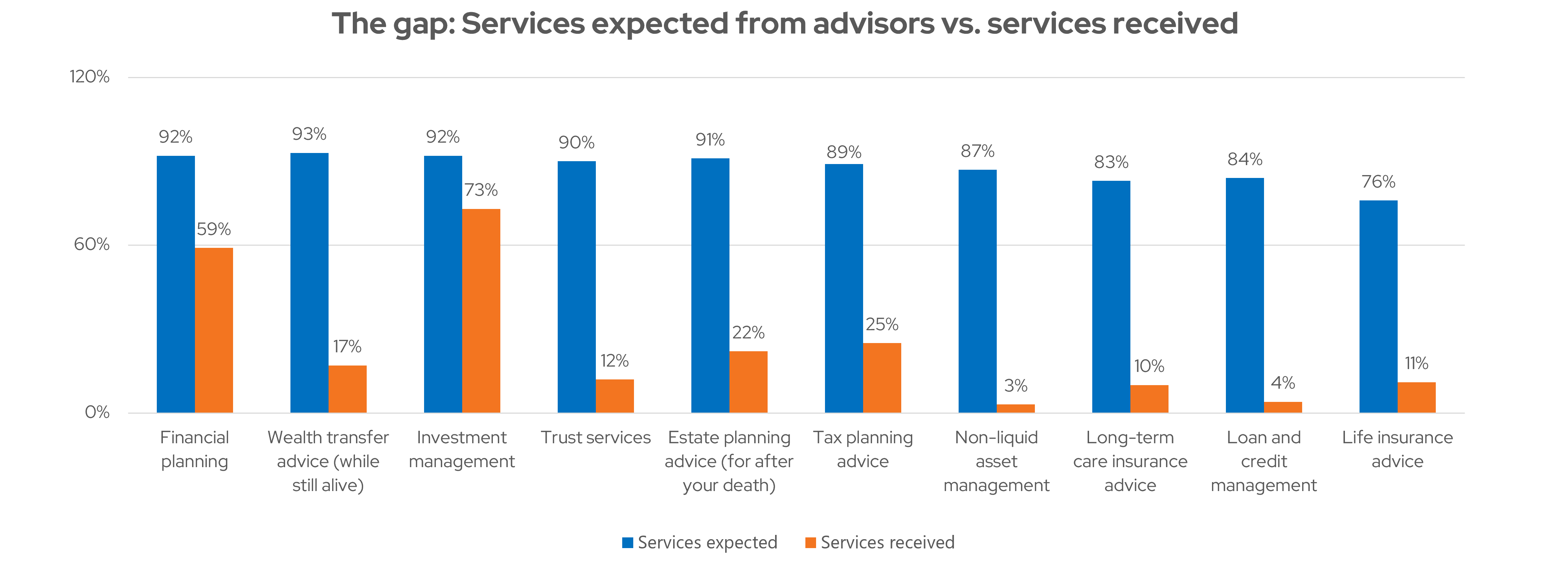

When it comes to financial planning and wealth management, most clients are receiving the service they expect. But when it comes to all other aspects of truly holistic planning, most clients do not feel they are receiving the services they expect. Adding more services to your value proposition increases your ability to meet HNWI needs. Specifically, there is a large demand for tax planning advice, estate planning advice, and wealth transfer advice.2

Adding these services is by no means easy to do on your own, which is why many advisors seek strategic partnerships in these areas. Today’s financial advisors tend to spend 800+ hours a year (40% of their time) on investment management.3 But consider that outsourcing investment management can free up hundreds of hours a year for client management and other activities.

In fact, outsourcers have been found to add $14.5 million to their assets annually, twice as much as everyone else. Data also shows that outsourcers tend to add 14 new clients each year, rather than the average four from non-outsourcers.4,5

In order to meet the long-term needs of your HNW clients and retain their business, focus on finding the partnerships that will empower you to expand your value proposition to include the services HNW clients want.

3. Personalize tax management

As 89% of clients expect their advisor to deliver tax planning advice, integrating tax management into your services is crucial for personalization.6 One way to accomplish that is to factor tax management into more of your conversations.

Implementation tactics might include:

- Explain how your recommended allocations address the client’s tax concerns.

- Incorporate tax-loss harvesting (if you haven’t already) and taking the time to explain it to your clients.

- Careful rebalancing that maintains a diversified portfolio and manages taxable income and events, possibly by using tax-advantaged accounts or using new contributions to adjust the portfolio mix.

Your HNW clients do not want one-sized-fits-all solutions. When you explain how you are taking steps to manage their unique tax situation, you are also explaining how you are delivering personalized service and value to their family.

4. Use actionable data for values alignment

Leveraging actionable data analysis to align a client’s values with their investment strategy involves using detailed data to identify and invest in companies or funds that match the client's ethical, environmental, and social priorities. For instance, analyzing data on corporate sustainability, social impact, and governance practices can help identify investment opportunities that resonate with a client's values, such as supporting green energy initiatives or companies with strong labor practices. This approach not only meets the client’s financial goals but also ensures their investments reflect their personal beliefs, enhancing client satisfaction and long-term engagement.

76% of HNWI under 40 list ESG as an important investment objective.7

Tip: Use asset titling to start the conversation

The topic of asset titling is a great conversation starter for wealth managers and an opportunity to provide value to HNWI because it touches on several crucial aspects of financial planning and can reveal much about a client's situation, goals, and potential risks. By initiating a conversation about asset titling, wealth managers can explore topics such as asset ownership and protection, estate planning, tax implications, and, of course, family dynamics. These critical areas can provide a comprehensive understanding of the client's situation and needs, opening the door to more detailed and tailored high net worth financial planning services.

How to build lasting HNW client relationships

Retaining HNW clients hinges on understanding their unique needs and delivering a sophisticated, personalized experience. By focusing on educational support, expansive product selection, tax management strategies, and actionable data analysis, wealth managers can create a hyper-personalized approach that has the potential not only to meet but also to exceed client expectations. Through these efforts, wealth managers can position themselves as indispensable partners, dedicated to supporting both the financial and personal goals of their HNW clients, which is good news for both retaining their existing book of HNW business and attracting new HNW clients.

Explore how Envestnet’s High Net Worth Consulting service empowers you to meet the expectations of high-net-worth investors.