|

||||||||

|

||||||||

Welcome to ENV 2 Insider, your monthly e-newsletter for quick tips on how to take advantage of your new, robust platform. |

||||||||

|

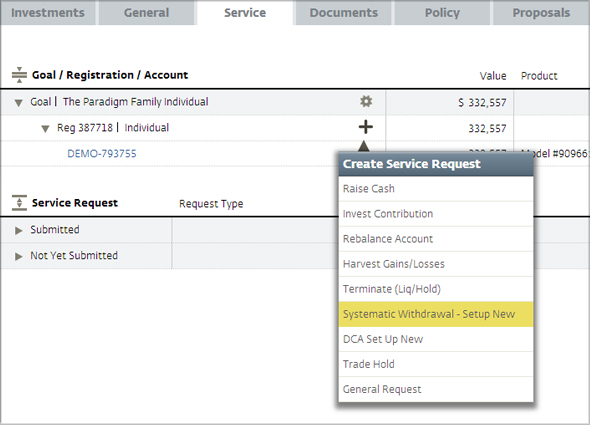

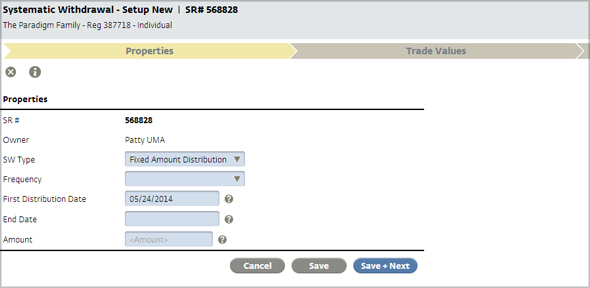

Tip of the Month Managing Systematic Withdrawals On ENV 2, setting up systematic withdrawals for a client account on a monthly, quarterly, or yearly basis has been made easier. Advisors now have more set up options and can specify the type of withdrawal desired – whether a fixed amount distribution or income distribution. Accounts can also be set up with more than one systematic withdrawal, as long as the frequency selected for each is different. A new service request option to modify existing systematic withdrawals has also been added. Step 1:

Step 3:

Adjustments to existing systematic withdrawals can also be a made by selecting the Systematic Withdrawal – Modify option from the Service tab. Modifications can be made to the withdrawal type, first distribution date, end date, withdrawal account, and amount. However, the frequency of an existing systematic withdrawal cannot be adjusted. Advisors would need to create a Systematic Withdrawal – End service request and then create a new request for the new systematic withdrawal. |

||||||||

|

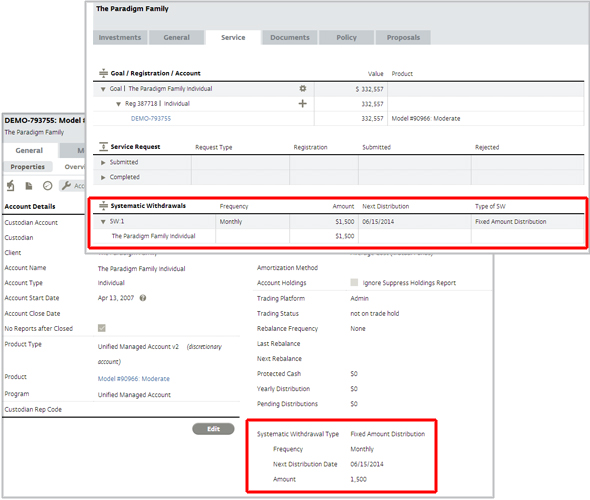

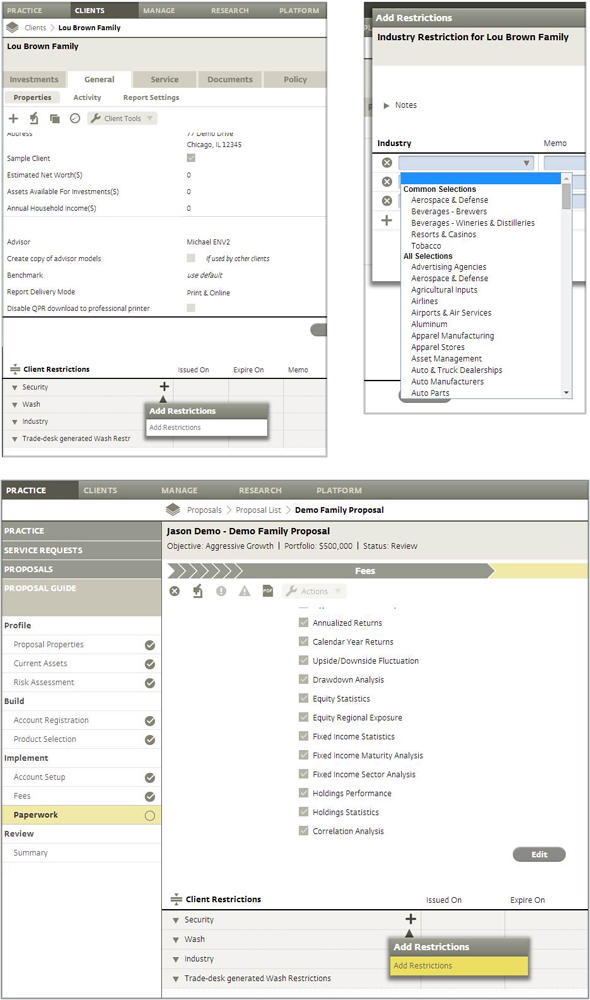

Feature Spotlight Adding Restrictions Advisors can set restrictions to client accounts to prevent investing in undesired Securities or Industries. Once a restriction is added, any security that does not meet the specified criteria will be sold during the next trading operation and any future purchases will be blocked for that specific client. ENV 2 follows Morningstar industry classifications and restrictions may be added from the Client page or during the Paperwork phase of the proposal process.

Additionally, Wash Sale restrictions can be placed to ensure that the securities sold in an account as a part of tax-loss harvesting are not re-purchased within the “wash” period of thirty days. These restrictions are placed automatically on the platform once the wash sales are executed. Advisors may also add restrictions manually by specifying the Ticker/CUSIP of the security. Wash sale restrictions expire after the wash period. |

||||||||

|

||||||||

| The information and analysis expressed herein is for general and educational purposes only and is not intended to constitute legal, tax, securities, or investment advice. The graphical illustrations contained herein do not represent any client information or actual investments. The information provided is based on currently available information as of the date of this writing and may be subject to change at any time without prior notice. Envestnet makes no representation that the information provided is accurate, reliable or error-free. Envestnet reserves the right to add to, change, or eliminate any of the services listed herein without notice. FOR ADVISOR USE ONLY - NOT FOR PUBLIC USE © 2014 Envestnet. All rights reserved. |

||||||||