This year at Envestnet Elevate, State Street’s Chief Investment Strategist, Michael Arone, and I had the opportunity to present a powerful keynote session, “The Battle of the Ages: The Generational Divide and its Implications for Investors.” Our goal was to have a really fun and engaging conversation around the future of our industry and how critical it is to meet each generation where they are.

There are four key things that I hope the audience took away from our discussion.

Generational insights give us important clues

Understanding the differences among baby boomers, Gen X, and millennials is more than just collecting some fun tidbits about each generation. These groups have shared experiences that are distinctly different from one another that make them tick. In our session, we specifically discussed generationally different technology (e.g., growing up with a cell phone vs. land line), historical events (e.g., the Vietnam War vs. the Berlin Wall coming down vs. 9/11), and cultural influences like music. These shared experiences and influences have shaped how each group thinks about the world and how they interact within it. By having a deeper understanding of where each group is coming from, our industry can do a better job of communicating with clients, as well as anticipating and addressing their particular needs.

Advisors are more important than ever

Our research shows, without question, that all clients want a human connection. Regardless of their generation, Americans believe that their human financial advisor is a better source of financial information and knowledge than all other sources – including their friends and family and the internet. They want to talk to you.

Among Americans using an advisor1:

- 83% of affluent clients feel secure in their current financial situation

- 86% have discussed market volatility and how it will affect their financial goals

- 89% value their advisor’s knowledge and guidance, and indicate their advisor has helped them remain confident

I don’t think we can stress this point enough. In a world where we can often feel digitally removed from clients and where technology is playing an ever-growing role in our lives, the advisor can still be the hero. Across every financial topic we asked about, our survey respondents felt their advisor was the best source of information, regardless of the access this digital world provides them.

Different generations often need different solutions

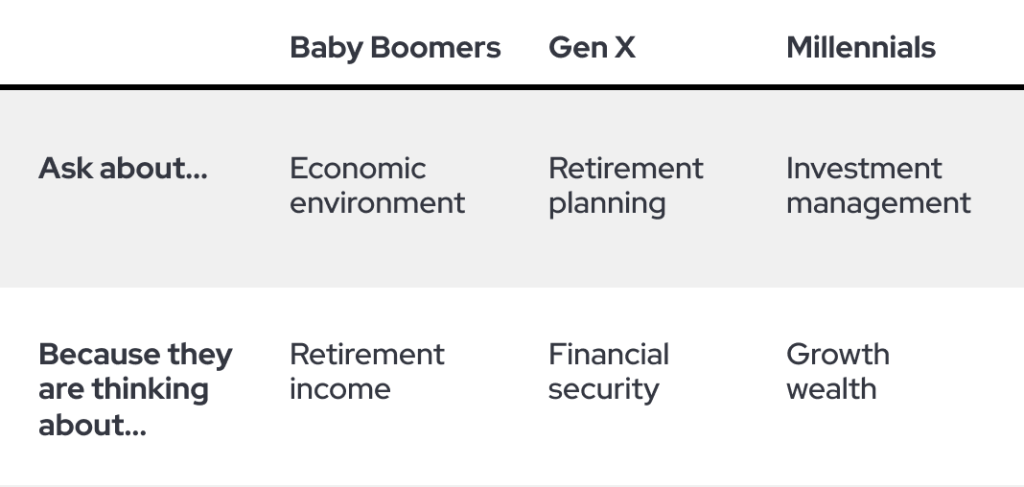

Michael and I spent some time talking about what each of the generations need, what their hopes and fears are, and how those insights might impact our industry.

The more research we do, the more it is abundantly clear that we can’t offer one-size-fits-all solutions to these groups. It is true that each generation is essentially asking the same question, “Am I ok?” but the important distinction is they are asking it about different aspects of their financial lives.

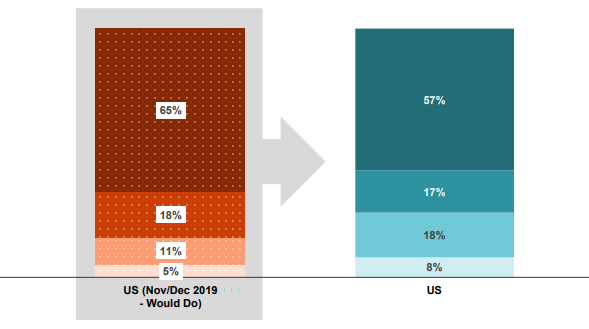

It is important to note that investor behavior has changed over time as well. In the U.S., with volatility in the market, fewer investors have left their money as is and stuck to their long-term plan and more have moved money to different investments to reduce loss compared to what they said they would do.

Advisors can play an important role in helping their clients to understand the value of long term goals and long term positions in the market. But that advice will certainly shift according to the client’s life stage.

Young vs. old dynamics could impact investors

Age demographics are starting to have real implications for investors. As Michael points out in his post, Battle of the Ages: What Young vs. Old Could Mean for Investors, by 2060, nearly one in four Americans will be 65 years and older, the number of 85+ will triple, and the country will add a half million centenarians. Combined with the falling U.S. birth rate and already high demand for skilled workers, the future could look a lot different from our status quo today.

Michael believes strongly that the growing friction between young and old could lead to the next “battle in the global populist war.” He issued a clear call to action, encouraging all Americans to engage now, rather than wait to see how future generations will solve the issues facing our economy. His take is an important reminder that understanding generational differences isn’t just about your business, but also could be a key part of understanding the global economy.

Technology and disciplined processes will drive growth

If we are going to effectively address the varied needs of our clients, we need to do it in a very scalable and efficient way. When I asked Michael about how he thinks about advisors delivering personalized service to their clients at scale, he brought up two great points. First, technology will continue to be at the heart of our industry’s growth. We spoke not only of how technology impacts how we engage with and involve clients in managing their own wealth, but also how tools like social media can support financial education efforts. While using social media can feel overwhelming or a trivial tactic, it has permeated the financial education and personal finance space, so it’s better to join the bandwagon than to get left behind.

But second, Michael spoke passionately about the importance of advisors building disciplined, repeatable processes into their practices that are designed to address the unique needs of each generation. By thinking critically about the processes put into place, advisors can increase efficiency while still providing the support clients need in whatever life stage they are in. Speaking openly and often about what an Intelligent Financial Life looks like, at all life stages, is key.

Conversations like these are a huge part of what makes our annual event Envestnet Elevate so special and rewarding.

Visit https://www.envestnet.com/event/elevate/ to save the date for 2024 in Phoenix, AZ and stay tuned to this blog for some more key takeaways from other keynote presentations of this year’s event.

1Source: Envestnet, State Street Global Advisors, ETF Impact Survey, November-December 2022